The banking industry has made great strides in Turkey thanks to the stability and accomplishments of the Turkish economy in the past decade. This progress is corroborated by the interest from foreign investors in the industry, which is growing into a more desirable market every day. At Türkiye Finans, we believe that participation banking can gain an increased momentum through the dynamism brought by new players that are expected to enter the market within 2015.

With a history in Turkey dating back to 1985, participation banks have significantly improved their market share in the past decade, reaching 5.3 percent as of the end of third quarter 2014. The participation banking industry displayed a 32.8 percent growth performance, while the banking industry scored an annual growth rate of 19.9 percent between 2005 and 2013. During the same period, participation banks have also achieved fast progress by branching out. They increased their total number of branches to 1,057, up from 290 in 2005 in Turkey. We expect these to reach the masses through branch network expansion and investments in new technologies and products in the coming period.

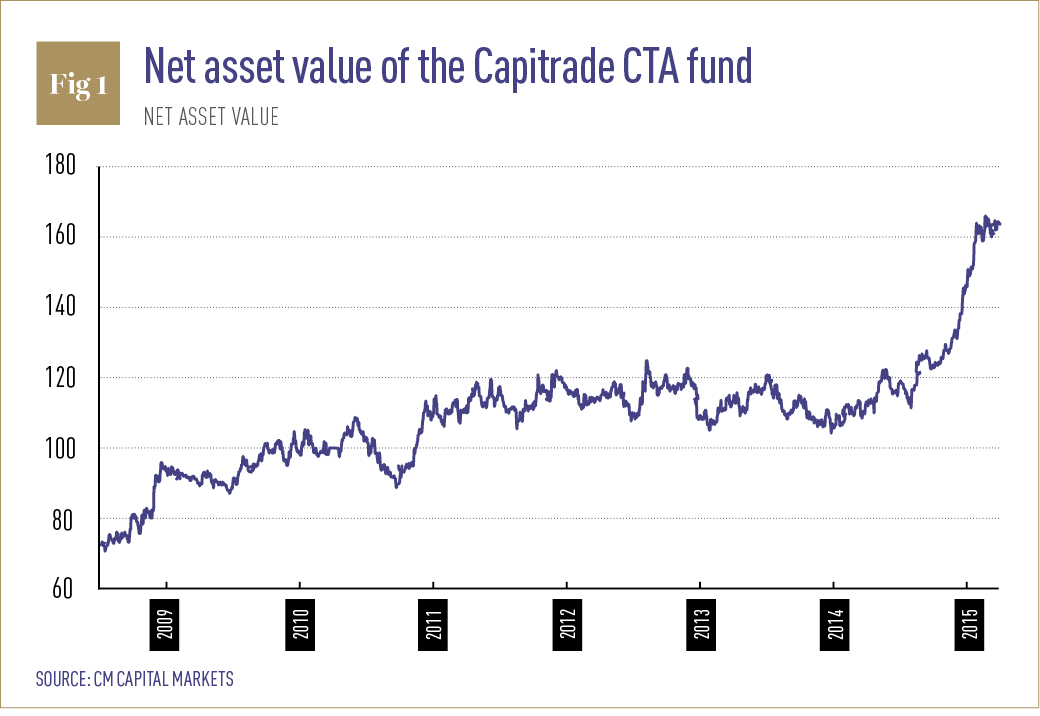

Mobile finance applications will no doubt be the most far-reaching technological trend in the banking industry to come. These applications have vastly utilised mobile devices, which means their importance is increasing as they are able to meet the needs of a larger part of the population. Consequently, Turkish banks are also introducing myriad banking innovations that are parallel to global developments. The new generation of banking customers is intimately familiar with technology and embraces the internet. In this sense, Turkey’s young population (see Fig. 1) is spearheading the use of technology and banking when compared to Europe.

With a history in turkey dating back to 1985, participation banks have significantly improved their market share in the past decade

Taking stock

Uncertainties abroad and high geopolitical risks marred 2014. These adversities have had a limiting effect on the financial industry and overall economic activity. Therefore, 2015 is a year of growing expectations in the Turkish economy and the banking industry – despite ongoing global challenges.

The banking industry continues to generate profits, and our return on equity is good compared to those of peer countries. Under the current outlook, this strength appears to be sustainable. There is an especially strong correlation between retail deposit shares and branch market shares of banks.

The importance of branching becomes more apparent when viewed from this perspective. Intense competition is likely to continue on the deposits front, as suggested by the loan/deposit ratio, which usually exceeds the 100 percent mark in the industry.

We also see that the banks are rushing to issue new securities to raise non-deposit funds. This trend is likely to continue, given the slower growth rate of deposits. Accordingly, we expect the number of sukuk issuances to pick up at an increasing pace compared to the previous year.Türkiye Finans boasts a pioneering participating banking attitude in diverse fields with an awareness and determination to preserve and carry forward the country’s cultural heritage.

The bank’s total assets increased by 25.6 percent to TRY 32bn ($13.6bn) as of September 2014, compared to the end of 2013. In the coming year, the plan is to continue to increase the number of innovative products we develop while maintaining a high growth rate. As part of our five-year strategy, we aim to achieve an asset size of nearly TRY 40bn ($17bn) by the end of 2015 through continuing to grow faster than the banking industry average every year.

The increase of sukuk issuances in global capital markets reinforces this product’s position among significant finance instruments. Türkiye Finans is shaping the participation banking industry in Turkey with various recent breakthroughs, as well as with innovative products and services. We provide support for the real economy so as to contribute to the country’s overall economy.

With our third overseas sukuk issuance, Türkiye Finans lead a first-of-its-kind practice both for Turkey and Malaysia. This was the first sukuk issuance by a Turkish company carried out in Malaysian Ringgit (MYR) while marking a record high for a foreign investor issuing sukuk in Malaysian markets. The size of the issue was 800 MYR ($221) with a tenor of five years.

Drawing on its robust capital structure, Türkiye Finans is proud to introduce yet another product to help diversify the support we provide for the real economy. We are the first participation bank in Turkey to issue a sukuk in order to help finance the real economy, and we shall continue to strengthen our position in this regard through new issuances.

Our recent issuance of TRY 60m ($25.7m) is the first domestic sukuk issuance aimed at a group of qualified investors. This issuance is the third Turkish lira-denominated sukuk issuance by Türkiye Finans in 2014.

In addition, we have issued a five-year sukuk in the amount of TRY 71m ($30m) for the commercial customer, making a good start to 2015. This is one of the first sukuk issuances to be offered by the real industry in Turkey. Our objective is to familiarise our corporate customers with this new and reliable fund-raising method by supporting them, and to continue contributing to the country’s economy by creating a sizable market base in this field.

Tailor-made products

We maintain a customer-centric approach with a vision of continuing to serve as Turkey’s pioneering participation bank. As part of this vision, we offer products and services to our customers according to the principles of participation banking. We carry out significant projects to take our technological infrastructure, business processes and service concepts to an even higher level.

In order to offer sector-specific solutions and advantages, we have changed the structure of our Siftah card – a faster, card-based version of the murabaha system – as well as of our Faal card. We are working on offering special deal packages for SMEs so that they can easily access banking services. Accordingly, we are entering into agreements and signing protocols with trade and industry chambers.

Recently, we signed a Credit Guarantee Fund (CGF) and Portfolio Guarantee System Protocol with Micro SMEs within the scope of the Micro Loans Project. Furthermore, we offered our customers specific insurance solutions to help SMEs secure not only their businesses, but also the process of their products and services.

Financing support for SMEs will continue to be on Türkiye Finans’ main agenda for 2015. In the meantime, our objective will continue to outperform the industry in both cash and non-cash loan growth in this segment. In addition to financing support – which acts as a leverage in the growth of SMEs – we will also continue to provide easier accessibility and proactive solutions aiming to answer company specific needs. In addition, keeping in mind its customers’ expectations and experiences, Türkiye Finans offers online and mobile solutions that allow customers to complete their banking transactions in just a few seconds.