Period of transition

Although the impact of the 2008 crisis is still reverberating across the globe’s financial markets, the commercial banking scene is looking more positive in 2015 than it has for some years

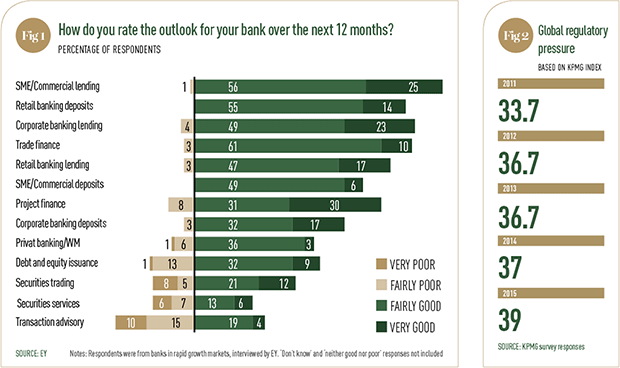

This year stands out for the commercial banking sector: there has been a sharper focus on boosting profitability, as well as a significant improvement in consumer confidence, which is vital for an industry that provides services such as basic investment products, including deposits and savings, as well as loans and mortgages. Although further improvement is needed in both areas, the path to recovery is certainly underway – particularly in the US, although there is also a positive feeling in emerging markets (see Fig. 1).

As the US economy continues to show promising signs of growth, a spillover of confidence into the banking sector is also occurring, which is driving a greater frequency of loan originations, particularly for commercial and industrial loans.

Furthermore, recent profits in the US banking industry have surpassed historic records, although return on equity is still sluggish and has not yet reached pre-recession levels or returned to double digits. That being said, analysts believe that 2015 may very well be the turning point in which this goal is attained, despite the various challenges that US banks still face.

Also showing promise is the performance of European banks, albeit at a slower rate due to the weaker European recovery. Moreover, an increasingly complex and demanding regulatory framework constitutes another considerable challenge in Europe. Initiatives aimed at promoting growth remain a key focus for European banks this year, although efficiency initiatives and reducing costs will take precedence, together with the implementation of risk and regulatory programmes.

This challenging landscape has hit banks in the Middle East and Africa even harder, with regulatory pressures and weak economic activity leading many to produce poor results and disappointing profits. The lack of a sustainable business model has further exacerbated this state of affairs in the region: de-risking balance sheets may have enabled many banks to meet regulatory demands, but they have hindered profitability for the most part.

Click to enlarge

Click to enlargeTech space

From the ashes of the recession, new challenges now afflict the sector. Most notably so far in 2015 is the increasing occurrence and ever-looming threat of

cyber attacks. Not so long ago, banks needed only sturdy walls, security personnel and a sophisticated vault to keep robbers away. Of course, such physical impediments were not always successful in keeping intruders out, but the physicality of the whole affair made it far more manageable. While over the years various security systems have benefitted from improvements, today the threat is far more elusive and difficult to nail down. In fact – as has been the case in recent incidents – the presence of intruders can go entirely unnoticed, sometimes for several months.

At present, cyber attackers seems to be one step ahead of the systems that they hack, and so are able to move in and out with relative ease. Protecting against this growing threat is crucial for the sector this year – more so than ever before. Unfortunately, providing sufficient protection against an entire system is not only incredibly expensive, but it is not always possible, and can severely disrupt a bank’s operations. To counter this challenge, some experts suggest that banks should implement steadfast protection for only the most crucial elements of their software, which is then complemented by more basic levels of protection for all other areas.

Adopting more advanced technology is also essential for meeting evolving customer expectations. Mobile banking and online platforms are key areas that require more sophisticated services in order to stay ahead of competitors, as those that do not evolve with the trends will simply be left behind. It is a new era for commercial banks, with growing rivalries in nearly every aspect of the industry.

Regulatory hurdles

As a consequence of the financial crisis, a more rigorous regulatory framework is now in play (see Fig. 2), and is by no means complete. One major shift, which is at the core of the global response to the 2008 financial crisis, is Basel III – a set of international banking accords that aim to strengthen balance sheets by increasing liquidity ratios and capital requirements. With the last of the Basel III ratios scheduled for 2019, the transitional phase is extensive and requires the continuous implementation of compliance and risk management processes in preparation for this endpoint. Therefore, it is essential that, through the course of the year, banks continue to improve data management, apply new risk procedures, develop their capital and liquidity strategies and stay updated with the latest regulations.

The challenge that remains for commercial banks in 2015 is conforming to the global regulatory reform agenda, while also delivering improved performance to investors and regaining customer trust. This may seem like an unachievable task, but through the thick fog of complex and strict rules, regulatory reforms are becoming clearer and the transition from design to implementation is currently taking place.

Naturally, banks must still contend with the intricacy and volume of new measures and the interconnected relationships between them all – yet signs of successfully implemented developments can be seen. Specific areas with new initiatives that are emerging in the sector include macro-prudential politics, risk weighted assets, comprehensive assessment, greater supervision, minimum requirement for eligible liabilities and total loss absorbing capacity. Moreover, in Europe, funding through wholesale markets has become easier for banks to access.

The future of the industry

As a result of the financial crisis and the ensuing restructuring, the industry has become more resilient, while lending growth is being supported via less restrictive policies in most sectors. The expectation is that this pattern will continue over the course of 2015. In order to survive a volatile environment and evolving trends, there is a need for banks to streamline services and deconstruct the products they offer, thereby providing bespoke solutions that better meet the needs of customers. This simplification of the business model will also allow more effective security systems to be enforced, together with more manageable structures.

A continued focus on improving digital platforms is also essential in order to cater to new customer demands and allow users to benefit from more encompassing facilities. Technology has now become the industry’s greatest tool, while simultaneously acting as its greatest weakness. A concerted effort to reduce cyber crime by reporting all instances across the world (which is currently only legislated in the US) can, together with smart strategies, lessen the threat in 2015.

Click to enlarge

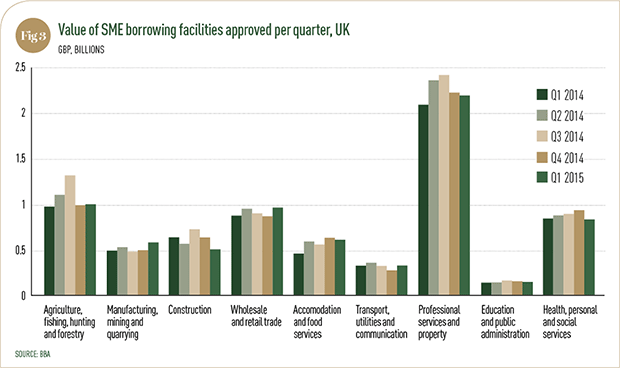

Click to enlargeConsistent growth is now taking place in the US, while European banks appear to be on course to catch up (see Fig. 3). However, other regions around the world, which are struggling with slow economic growth and regulatory pressures, may have to drastically transform their business models in order to achieve sustainable growth and profitability.

Generally speaking, with improvements to all aspects of commercial banking being made and a more in-depth regulatory focus – which at first serves as a challenge, but ultimately benefits all parties in the long term – in place, the sector may not simply return to its previous level of success, but actually become stronger than ever before. The best commercial banks in the world can be found on the following pages.