Where wealth resides

Private banking is an important part of the market, creating a space for high-net-worth individuals to get the best from their money. In that space, a number of pivotal players operate

The private banking sphere allows those who want more than a basic current account to enjoy the fruits of their labour. It’s important that banks can make the distinction between mass-market retail banking and products and services that can attract and appeal to high-net-worth individuals; services that can be very profitable.

Customers of private banking institutions generally demand the highest in client relation standards, and so these organisations must throw as much weight as possible at pleasing them. It is this expected high level of service and product offering that makes this category so interesting, and one that guarantees a range of votes and opinions from our judges.

Click to enlarge

Click to enlargeBanking with the best

With wealth managers and dedicated fund experts offering a range of expertise, the private banking segment attracts some of the most well respected bankers of the age. Nurturing large sums of individuals’ cash requires no small amount of insight and deliberation, and it can take a seasoned professional to be able to sift the wheat from the chaff when it comes to selecting a client’s risk balance. It’s the subtle nuances of getting this right that make for a highly competitive and hard-fought industry. If it doesn’t provide the very best in financial advice, a private bank may as well shut up shop.

Private banking dates back centuries. For as long as banking has been in existence, the need for a top-end service has encouraged many organisations to create a space for the wealthiest members of society. Traditionally, aristocrats and the gentry have demanded high-level services, much like in any other aspect of their lives. And banking, for this portion of society, has always been about creating wealth – not just stashing rainy day cash. On top of that, customers have always expected money to remain safe for future generations and to generate wealth for their offspring. Today, things aren’t so different.

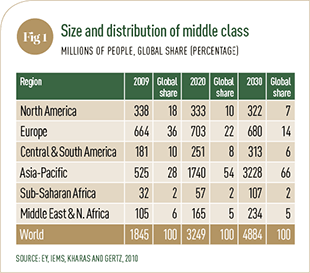

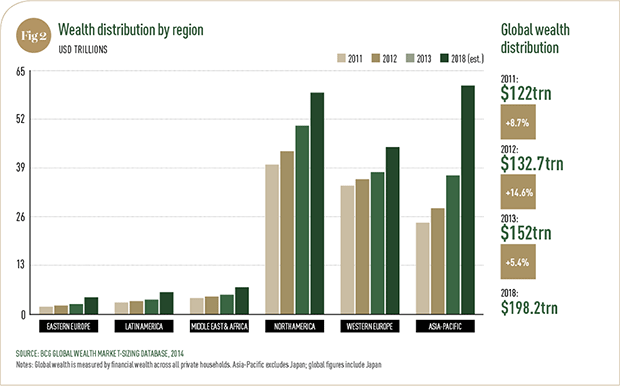

Over the course of the last half century, the rise in the middle classes (see Fig. 1) across many of the developed nations has created a far larger market that has fanned the industry. The rise in popularity in the more general retail banking products and services has led to better standards across the personal banking sphere, and private banking has not been unaffected. With more and more members of society boasting increased disposable income (see Fig. 2), the requirement for continually improving high standards in private banking has seen the industry enjoy more notable attention across the board.

High-net-worth individuals also expect their monies to be accessible and managed on an international scale, so while the demand for a localised and custom service is ever present, it must also be transferable across the world. To account for these demands, often a sophisticated branch network and sound international relations are required to ensure smooth business is conducted. With the internationalisation of the economy changing financial performance requirements everywhere, this has become both a lot more complicated and also a lot more tightly regulated, given the scramble for control from national and supranational regulators. As such, private banking institutions are in a position in which they must create innovative and effective international supply chains.

Click to enlarge

Click to enlargeNew money

A huge new market of banking services has surfaced over the last few years, as emerging markets have become more and more sophisticated. With the rise in middle classes, those requiring private banking services have grown substantially in numbers. As countries have grown in prosperity over the last couple of generations, a number of banks have been caught out with substandard client offerings and undiversified product bases. Since this has become a realisation a number of high quality outfits have sprung up, both from old and new institutions. In these new markets a plethora of standards exist, yet only a few survive long enough to fully capitalise on these sizeable and growing platforms.

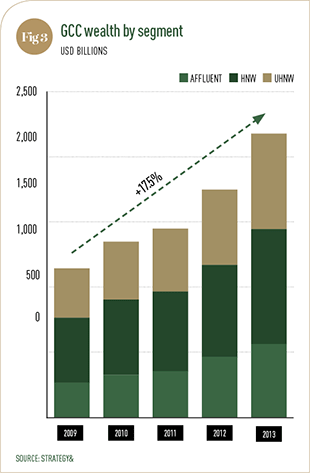

Up-and-coming finance centres across the world have done their part in building these new markets. With large-scale commercial and financial hubs growing exponentially, in cities from Toronto to Singapore, more and more educated individuals with greater wealth require better and more flexible banking services. As these regions grow in stature and importance, the needs of their populations naturally become more advanced. In such areas, private banks are really expanding to succeed and have created valuable offerings to attract individuals. With wealth flowing into these cities, generally it stays there and builds upon itself (see Fig. 3) as the investment multiplier goes into overdrive.

Click to enlarge

Click to enlargeOn top of that, there have been notable regions in which private banking has thoroughly taken off. In Asia in particular, private banking has risen in popularity, from being a niche service to almost taking on the mainstream banking market – such has been its success.

Technology has also played a large part in the growth of private banking in the last few years. With new apps and software connecting much more of the world than was previously possible, banks and financial institutions have found it easier to expand and deliver the service their clients demand. Transactions happen with greater ease and can occur instantaneously across borders, opening up more opportunities for arbitrage among the top performers and those with access to the most up-to-date technology. With these latest advances in technology and the increasingly widespread use of superior computer hardware, private banks can access their clients with greater ease.

Best of the best

With the wind in its sails, private banking has gained a significant amount of ground in the years since the credit squeeze. More and more bankers are demanding more from their service providers, and with competition increasing across the range, it’s a sector on the move. Indeed, private banking is considered by many to be a part of the industry worth watching.

This is why World Finance researches the entire globe to select the very best. Monitoring often-fluctuating levels of competency, the magazine selects those innovative and forward-looking firms and organisations that have stood out during the last year and pushed the competition on to new levels. With help from the magazine’s loyal readership, the judging panel considers a range of criteria that allows it to focus in on the issues that matter for those looking for private banking services. On the following pages, you’ll find the very top performers in the industry.