A future built on finance

Financial services as a sector has accepted additional responsibilities for the communities it serves, and indeed the planet as a whole. New ventures and major players agree that sustainability is the only viable plan

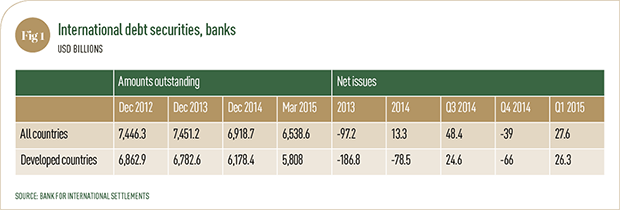

The financial services industry has gone to great lengths of late to inject a culture of shared responsibility and values into proceedings, and in banking – where a stable and sustained recovery is steadily taking hold (see Fig. 1) – extreme care has been taken to regain the trust of disillusioned parties.

Click to enlarge

Click to enlarge“The cumulative impact on the industry’s public reputation of compliance breaches, product mis-selling, computer failures, data leaks and benchmark rate manipulation is impossible to measure precisely, but it has been severe”, reads EY’s Global Banking Outlook. However, the steps taken in the time since the crisis have done much to overturn past wrongdoings, and succeeded in giving rise to a new breed of banking, unrecognisable from that of its pre-crisis complexion.

Sustainable banking – defined as any institution whose focus falls on the triple bottom line of environmental, social and corporate governance issues – has enjoyed yet another bumper year, and promises to commit further still to the task of driving sustainable growth. Racking up greater returns than some of the better-known, more traditional banks, the subsector has proven beyond all reasonable doubt that sustainability need not come at the expense of profitability.

Looking at the banking sector overall, the sheer scale of the transformation is unprecedented, and a greater number of mission-driven banks have risen to industry changes by taking on new responsibilities. No longer dictated by the single-minded pursuit of profits, sustainable banks are investing in both human and natural capital in a bid to bring positive and progressive change to the communities in which they operate.

In this year’s World Finance Banking Awards, we recognise the names that have done the most to foster inclusive growth and bring cultural and behavioural change to the financial services industry.

Sustainable real economy

Rather than focusing on the narrow task of turning a quick profit, sustainable banks are also occupied with serving the real economy and contributing to the drivers of growth, be they SMEs, individuals or big business. “A sustainable real economy requires enterprises that deliver economic resilience, environmental preservation and social empowerment to the communities in which they operate. These enterprises need not only direct investment capital but also access to financial services including lending, deposit and cash management products typically delivered by banking institutions”, according to a report by the Global Alliance for Banking on

Values (GABV).

Finding finance for underserved segments of society is a task that has fallen squarely in the lap of sustainable banking, and this commitment to inclusive growth has handed fresh opportunities to peripheral segments of the community. In emerging economies, where banking penetration is far short of its equivalent in the US and Western Europe, for example, banks are reaching out to consumers in less-than-ideal situations and bringing them into the formal system.

In the US, the FDIC National Survey of Unbanked and Underbanked Households shows that some 20 percent of the American population operate outside of the formal system. “In order for underserved consumers to choose financial services in the mainstream banking system, banks must offer products or services that those consumers perceive [will] meet their needs – and those consumers must be aware of the availability of those products or services”, according to the survey. The role of sustainable banks, therefore, is of inestimable importance in reaching underserved populations and in strengthening the relationship between consumers and banks. Essentially, the subsector’s ability to reach underserved segments of society feeds into a much broader ambition: to improve financial inclusion and reassure customers that the sector is a much-changed proposition from that of years past.

Integrated transparency

Aside from inclusion, another of the subsector’s core values is transparency, and the measures taken by sustainable banks recently to make clear their commitments to the economy, society and the environment are perhaps best summed up by a continued adoption of integrated reporting. By acknowledging the significance of natural capital, sustainable banks have made clear their commitment to corporate social responsibility at every stage of the value chain.

By providing stakeholders with a more complete assessment of value, sustainable banks have chosen to include details aside from mere finances in outlining their long-term credentials. Whereas traditional corporate reporting can often leave investors ill-informed about matters beyond the coming year, integrated reporting allows them to measure the impact of the business on the economy, society and the environment. “There is growing recognition that the range of issues and opportunities affecting long-term business value is much broader than can be reflected in a set of current year financial measures”, says a KPMG report on the topic. “Integrated reporting provides a basis to address this by re-focussing reporting around an organisation’s business model and operational priorities [see Figs. 2 and 3].”

Click to enlarge

Click to enlargeBy reframing banking as a service first and not merely a profit-making machine, sustainable firms have been able to instruct an industry-wide paradigm shift and demonstrate to stakeholders that banking is a much-changed proposition. “Strengthening the diversity of the banking ecosystem through the growth of banks with business models based on the principles of sustainable banking should provide shared value not only to society but also to the banks and their investors choosing that model”, according to GABV.

Developing sustainability

Another important aspect worthy of recognition is a sharpened focus on the issue of social and environmental wellbeing in emerging economies. Most notable since the turn of the 21st century, mature economies have strived to introduce a greater measure of sustainability to the banking sector, and while the same can be said for the developing world, it’s only in recent years that policymakers have taken strides towards this end.

Nigeria, Brazil, China, Indonesia and Mongolia are just a few of the countries to have recently introduced protocols of some description to set banking on the path to sustainable prosperity. Recognising that the sector is partially responsible for the continued success of the population in question, guidance on this front has proven valuable in reaching underserved segments of society and in improving social and economic wellbeing generally. For a collection of the most impressive such institutions working today, see the winners of this year’s Sustainable Banking Awards on the following pages.