Traditional no more

Competition from new market entrants has forced commercial banks to reconsider age-old operating models and double down on the central issue of profitability

Commercial banking has undergone an extraordinary transformation, and the challenges for the sector are such that any bank must deliver more with less in what remains a distinctly low-growth environment. Times are just as hard for businesses, and with confidence low and opportunities slight, the commercial banking sector has a great deal to prove if it is to adapt to a radically altered landscape.

We do not see marketplace lenders as a major threat to banks in the mass market

Last year commercial banking was notable for its focus on profitability and for its focus on making improvements to consumer confidence. In that respect, this year has seen little change, and while times – as ever – are tough, there is a renewed sense of optimism about where the sector is headed. The latest World Finance Commercial Banking Awards pour over the names that have really excelled this year, and offer an insight into the developments that have already made it one to remember.

“In many ways, the financial services industry is on more solid footing than it has been for quite some time”, said Deloitte’s latest Banking Outlook. “But concerns – some new, some old – are keeping industry executives on their toes. Whether it’s the evolving threat of cybercrime, the rising cost of regulatory compliance, or pressure coming from non-traditional competitors, financial services leaders have challenges aplenty. Agility, innovation and collaboration will be important to capitalise on new opportunities for growth.”

New competition

For more than five years the industry has been faced with wave upon wave of new regulations, so a great deal of effort has been put into the arduous task of compliance. With a more in-depth regulatory focus driving improvements to all aspects of commercial banking, what at first was a challenge could ultimately benefit all parties. Assuming this is the case, the sector may not only return to its previous levels of success, but actually grow stronger.

However, unlike investment banking, the biggest challenge for commercial banks is not regulation but competition. Digital technology has radically altered the market and new operating models have emerged.

According to EY’s latest Banking Outlook, “as in retail banking, there has been a revolution in the provision of financial services to businesses. Not only has there been the development of P2P lenders providing debt financing, but also P2P equity investment platforms. In addition, some crowdfunding initiatives offer rewards to investors: rather than prioritising a financial return, investors pre-purchase products or experiences”.

Click to enlarge

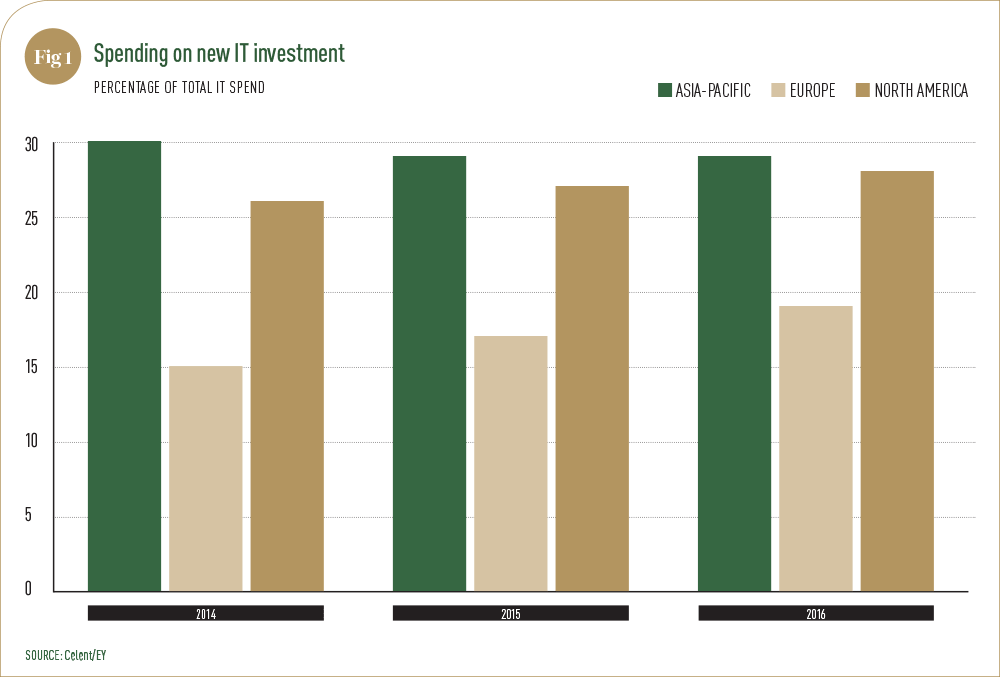

Click to enlargeWhereas in years past traditional commercial banks were, while certainly the only, at least the go-to method of financing, their monopoly on the marketplace has slipped. P2P financing has captured the public’s imagination and in many instances forced traditional players to reconsider age-old operating models. The emphasis on technology in particular has given commercial banks incentive to boost investment in IT (see Fig 1) and broaden their horizons in terms of clients.

Security has been subject to a fair few upgrades this past year

As impressive as these technology-first platforms appear, and as numerous as their advantages are, the consensus is still that, while they have been successful in shaking up the banking sector, they are not necessarily a challenge to their dominance. “Contrary to a number of commentators, we do not see marketplace lenders (MPLs) as a major threat to banks in the mass market”, said Deloitte’s Head of UK Banking Neil Tomlinson in a recent study. “Borrowers like the benefits of speed and convenience of MPLs, but those willing to pay a material premium to access loans quickly are in the minority. Whilst banks are yet to replicate the benefits of the MPL model, we believe it is only a matter of time before they use their size and scale to overtake and sustainably under-price MPLs.”

This isn’t to say these MPLs have in no way influenced the latest developments in commercial banking; many traditional banks have taken heed of the cost advantages and looked to lower their legacy operating costs accordingly, while others have taken the shifts in lending as a signal that investments seen as risky in years past are perhaps not as dangerous as originally thought.

Despite the added advantage of reduced operating costs and lending rates, the fact remains that investors are as yet unconvinced that their savings are safer with P2P lenders than they are with traditional banks. And while it’s true perceptions could improve in the future, it appears for the time being that more traditional names are doing enough to compensate investors for the cost disadvantages of more conventional options. EY said: “Although threatened by these new competitors, we believe banks can respond by building partnerships or making acquisitions. They can also become more effective at competing directly. Only in extremis, when they are unable to fund the investments to address this new era of competition, might they have to exit certain business lines.”

Remaining profitable

Another issue doing the rounds is the all-important matter of profitability. More complex than mere lending growth is balance sheet management, which has asked banks recently that they find savings and rethink age-old operating models. Ultimately, the issue of profitability boils down to composition of assets, and banks must go further to seek out revenue-generating assets if they are to survive in a constantly shifting landscape.

In a bid to differentiate their services from the next, a lot of banks are focusing on mobile solutions and internet banking generally. Breaking down the barriers for the customer is one thing, but it appears this year’s hottest trend is to improve the customer experience either through technologically superior products or dedicated customer service. Security, meanwhile, has been subject to a fair few upgrades this past year, in a bid to appease customers for whom the issue has slowly been shifting into focus.

Technology, security, regulation; all these issues and more demand that commercial banks keep profitability front and centre in their minds when it comes to making important business decisions. As demanding an environment as it is for commercial banks right now, the winners of this year’s awards are proof the current climate is not without its opportunities. Having taken into account a whole host of factors, the Commercial Banking Awards represent the best of what the sector has to offer and give some indication as to where it might be headed.