Increasing assets under management is not always advantageous

The underlying cause of this evolution can be attributed to recently established requirements, from new OECD guidelines, to cross-border regulations and know your customer, which, collectively, have sent seismic waves throughout the world of private banking.

Implementing a new strategy is critical for private banks in the present climate. A major part of this is redefinition, whereby expansion is reined back and geographic presence is focused. In line with this change, big players in the field are making a marked effort to reduce their global footprint in terms of their private banking enterprises.

One of the most notable trends to hit wealth management institutions this year is offering a more progressive customer experience, which has partly grown out of mounting customer expectations. As a result of the global financial crisis, clients have a far greater awareness of their financial affairs, and, as a result, are taking a more active role in their wealth management. In effect, individuals are paying greater attention to risk management, compliance and the reputation of the institution they are dealing with. Banks too are focusing much more on risk management in 2016, taking measured actions to improve their existing systems, while also introducing new and more integrated processes. Numerous private banking bodies are still undertaking this transition in a bid to ensure their clients’ ever-changing needs are constantly met.

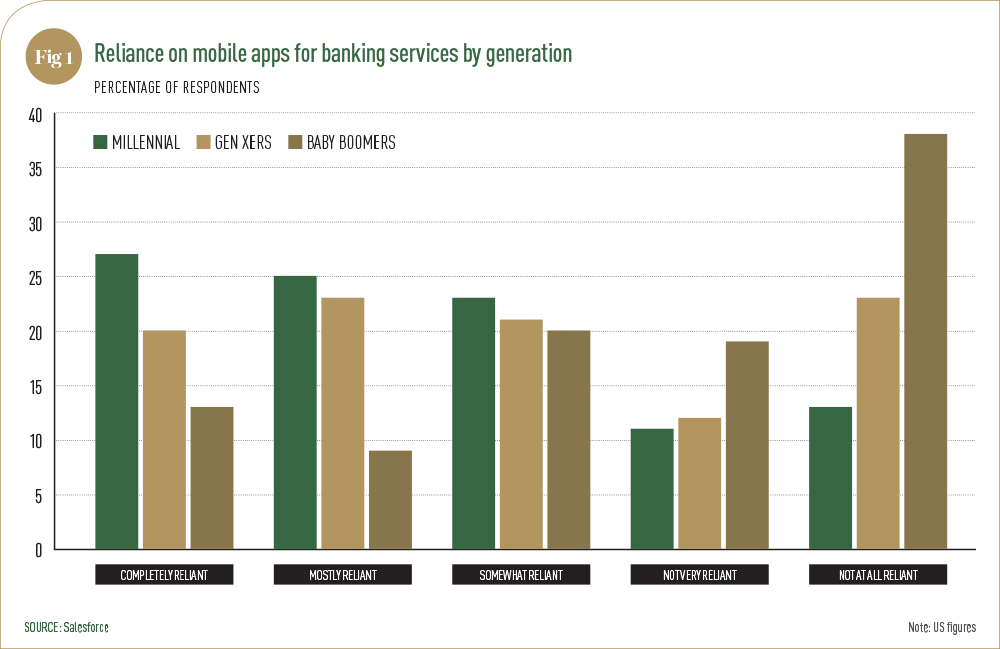

Although shifting demographics and the transfer of wealth from one generation to the next will disrupt current relationships, and thus create gaps in numerous firms, they also provide a vast array of new opportunities for less established institutions. Moreover, they offer the potential for a greater market share for individual firms – both old and new – as long as they can cater to this generation.

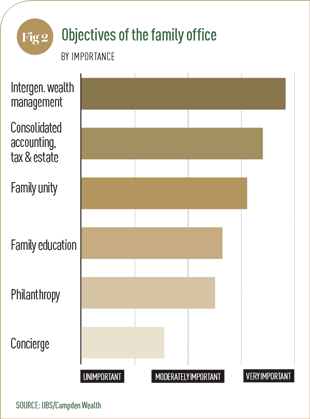

Concerns regarding longevity of investments are also increasingly important, forming an integral part of communication between investors and wealth managers. It is this shift in investor mentality and private banking culture that has seen family offices grow in popularity. Although the exact meaning of the term varies from place to place, the family office was created to look after the wealth of extremely high-net-worth families – though they have traditionally offered far more than just guardianship of capital (see Fig 2). These niche institutions are trusted with various personal matters, often acting as mediators between squabbling siblings and governors of trusts, while keeping all aspects of family life organised – from education to domicile and travel.

The new generation of clients has raised the standard of service and engagement from their wealth managers

Out of the original concept of the family office, two variants have emerged: the single family office and the multi-family office. While the former fits in neatly with the paradigm of a traditional family office, the latter, as the name suggests, branches out to include numerous families. The past year or so has seen multi-family offices grow in number and popularity; this trend again can be attributed to the financial crisis, which led more people to seek highly personalised investment advice and asset management. Adding to this upsurge in interest are the changing demographics mentioned above of a growing number of first-generation affluent individuals.

As the climate of global uncertainty persists in the coming year – together with more newly wealthy families from emerging economies – the demand for family offices is expected to grow. That said, with increasing regulatory pressure and competition, whether all players currently in the game can maintain their course is yet to be seen.

While pulling back geographically and applying greater focus helps wealth managers to concentrate their resources, greater investment into technology is also critical – but draining. Moreover, the talent required nowadays is an additional cost that continues to escalate, given the level of expertise needed, the expensive training required, and the current rate of retirement by the previous generation.