The future of financial technology

As more banks commit to incorporating fintech systems into

their everyday operations, the way customers view the industry

is beginning to change

Retail banking forms a vital part of every economy; by allowing consumers to safely deposit their money while creating capital for other consumers to lend – such as in the form of a mortgage to buy a house – it has become one of the foundational elements of every advanced and mature market. Likewise, retail banking also allows consumers – upon whom most of the world’s developed economies are based – to better manage their spending through access to credit and debit cards.

Fintech prospects

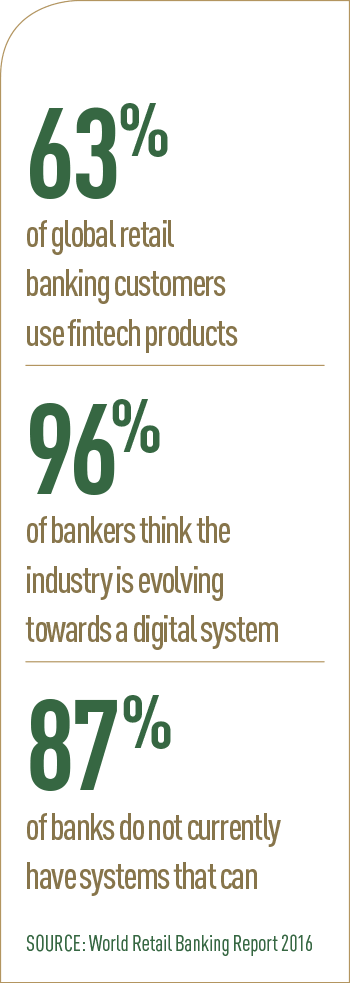

With its roots in the 18th-century Enlightenment, the retail banking industry continues to grow and evolve. One new and particularly significant development is the growth of financial technology. The World Retail Banking Report recently flagged these changes up as especially crucial in 2016, finding the majority of retail banking customers – 63 percent, to be exact – were in some way using fintech products or services.

At the same time, 55 percent of those users said they would recommend fintech providers to their family and friends over their regular bank. Fintech’s most enthusiastic users appear to be the global young, and consumers located in emerging markets.

Fintech’s most enthusiastic users appear to be the global young, and consumers located in emerging markets

This growing adoption and use of fintech has not been missed by leaders of the world’s retail banks. As the World Retail Banking Report also noted, 96 percent of banking executives believe banks need to push ahead with further digitalisation, and adopt more fintech products as part of this drive. However, while the importance of this is recognised, it has yet to be fully adopted into practice, with more than a quarter of bank managers continuing to view fintech as a competitor rather than a potential partner (see Fig 1). Furthermore, only 13 percent of those who agreed further adoption of fintech was important have the systems in place to support it.

Click to enlarge

Click to enlargeWhat this means is we are likely to see a gradual increase in fintech adoption over the coming months, as banks begin to plug the gap between recognising the importance of technology and actually incorporating it into their business models. At the same time, those banks that do already have a system in place to support fintech adoption – or have already set out on the path to instating one – are in a good position with regards to what will be an increasingly vital and defining aspect of the future of the industry.

As the young consumers who are most comfortable with fintech products grow older, so too will the market base for such products. At the same time, as emerging markets hopefully continue to steam ahead and economic modernity takes further hold, the number of customers demanding fintech – particularly in relation to smartphones – will increase. In the developing world, many consumers have technologically leapfrogged computers and laptops, favouring cheaper and more easily portable smartphones. As a result, the demand for fintech products in these regions is likely to be high.

There is also a schism between how banks and consumers view fintech: whereas more than 80 percent of users claim fintech products are faster and quicker to use, only roughly 40 percent of banks felt the same. Furthermore, bank managers must more keenly recognise the benefits fintech can have in improving their services – many do so already, but progress must, and will, continue on this front.

From physical to digital

From physical to digital

Connected to the spread of technology and general digitalisation of retail banking is the increased move away from bricks and mortar. All across the industry, banks are closing branches or downsizing their operations. This is not mere cost-cutting: it is a drive to adapt to the new technologies and consumer habits of the digital age. Smartphone and online banking have both played a large role in this, but so too have the technological development and increased use of ATMs, which now offer more transaction services and customer support than they have in the past.

However, with this digitalisation and subsequent move away from physical encounters with bank tellers, security has become a renewed issue. With the lack of face-to-face authentication, retail banks have had to adopt more robust security features for their online and mobile banking services. Many banking apps now use biometrics – usually in the form of a fingerprint on a smartphone – in order to secure verification, while mobile banking often requires a layered approach, employing a number of different stages of authentication. As retail banking continues to transition from the physical world to the digital, companies will be sure to look for ever more secure ways to ensure customer privacy and security.

However, the move towards digitalisation – both for banks and society in general – also provides an abundance of new opportunities. Using digital and online technology allows banks to collect big data from customers, and already organisations are recognising the potential of this. The technology consultancy firm Capgemini found 60 percent of financial services firms in North America believed data analytics provided a competitive advantage, while more than 90 percent believed the market winners of the future will have to engage in successful data collection and utilisation initiatives.

In terms of transaction security, American banks are looking to catch up with the rest of the world: many US retail banks still offer magnetic strip transactions for credit and debit card users, as opposed to the chip and PIN technology that has been adopted by most advanced economies. This is clearly a security issue, as magnetic strip technology more easily allows someone to illicitly acquire and use another person’s credit card than the chip technology – which requires the user to know the correct PIN for the card – that is ubiquitous in most of the world. However, while magnetic strip cards may remain in use in the US for a while more, they are likely to be gradually phased out over the coming year.

North America also has some catching up to do with regards to the implementation of fintech across its banking sector, with only 59.1 percent of customers currently using fintech products or services on a regular basis (see Fig 2).

Click to enlarge

Click to enlarge

Chinese growth

Another exciting trend is the growth of Chinese retail banks. The Chinese Communist Party has committed itself to developing its own internal consumption, raising the incomes of citizens and moving away from the heavy investment model that has served it so well. According to the Boston Consulting Group, 81 percent of consumption growth until 2020 will be among middle-class households, whose annual income is already more than $24,000. More income means more spare money, which in turn means a larger propensity to save.

But China’s retail banks are also in a state of flux. Chinese consumers tend to be less loyal to their primary bank, while at the same time the country’s ‘big four’ have seen their market share eroded in top tier cities across the nation. It can therefore be expected that new, leaner, more competitive banks will emerge from the mix and potentially expand to other areas of the world, beyond the confines of the Chinese state.

There are two main trends within retail banking at present: increased financial technology and digitalisation, and the rise of China as both a retail banking market and a competitor to already established banks abroad. Both these developments have gained considerable momentum this year, and should continue to do so in the future.