Sustainability need not come at the expense of profitability

The World Finance Sustainable Banking Awards offer an insight into the extent to which the issue of sustainability has penetrated the banking industry, and how sustainable products and services can not only boost the credibility of financial institutions but their profitability as well.

The attributes that make for a leading bank are changing, and countless new strategies have emerged to replace the operating models of old. In EY’s latest Global Banking Outlook, the professional services firm made a point of whether ethos counts for more than earnings, and questioned whether customer connections are more important than compliance in the present climate. Whether customers choose to accept it or not, banks have an important role to play in their day-to-day lives, and, in the right environment, can be powerful agents of change.

More and more consumers want their decisions to contribute to making the world a better place

“The discernible shift that many banks have made in recent years towards addressing the environmental and social impacts of their financial services is a welcome and important first step in this direction”, according to a report by BankTrack. “More and more banks realise that ignoring social and environmental issues could considerably increase their exposure to credit, compliance and reputational risks. The progress banks make in this field, however, will be measured not by good intentions or even by strong policies on paper. To » advance sustainability, banks must seek improved performance and results on the ground in affected communities and environments.”

In only the past year, a whole host of countries have launched national policies, guidelines, principles and roadmaps in a bid to embed sustainable banking practices, according to the International Finance Corporation. Although not all are mandatory, these initiatives go to show the importance of state support in facilitating this expansion of thought. The State Bank of Vietnam, for example, issued a directive to promote green credit and sustainability risk management, while China strengthened its tools to monitor the many and various issues tied to green banking. Meanwhile, Kenya adopted the Sustainable Finance Guiding Principles, and Peru launched the Regulation for Social and Environmental Risk Management.

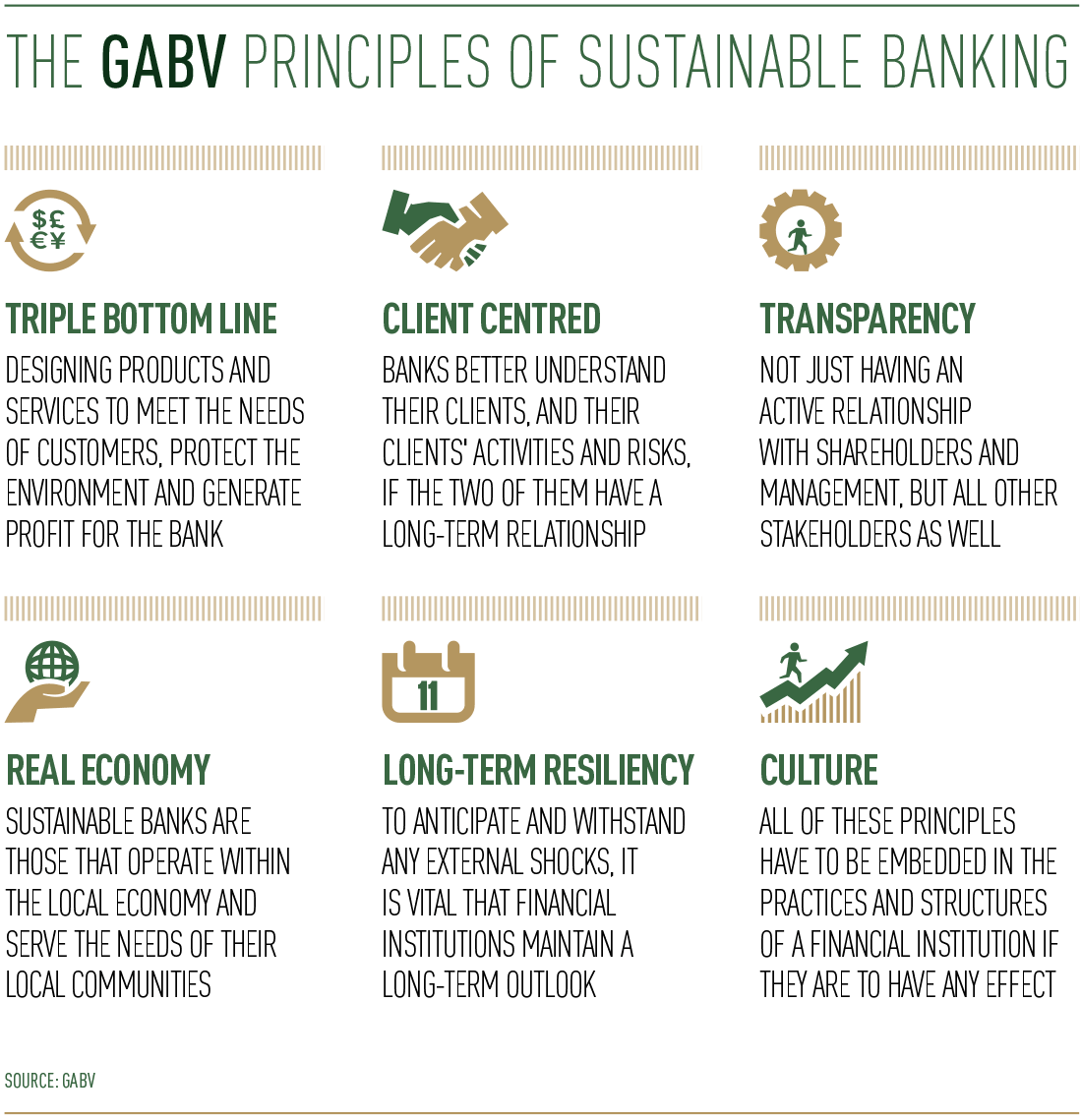

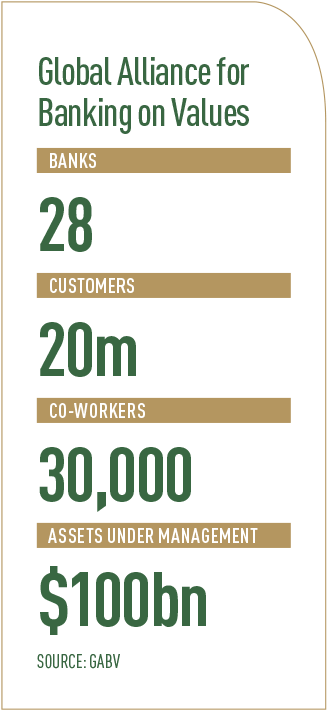

Another indicator of sustainable banking’s growth can be found in the Global Alliance for Banking on Values (GABV), which is made up of the world’s leading sustainable banks. Established in 2009 by nine banks, the network has gone from strength to strength, and its membership continues to grow. The GABV now has 28 members, serving 20 million customers, and holding up to $100bn of combined assets under management.

Beyond survival

According to a recent McKinsey report, “the sector as a whole… must look beyond survival and plan for the future”. Again, “banks should aim high, fundamentally transforming their economics, business models and culture – what we call a ‘triple transformation’”. Most important of all perhaps is the fact that the success of banks is no longer determined by profitability alone. For many, a commitment to sustainability is equally as important and, without it, there’s no reason to believe a bank can survive in what remains a hypercompetitive and increasingly complex environment.