Established in 1994, Baiduri Bank is part of the Baiduri Bank Group, one of the largest providers of financial products and services in the sultanate. Its shareholders include major players such as Baiduri Holdings, Royal Brunei Airlines, Royal Brunei Technical Services and the French banking giant BNP Paribas. With this strong backing, the bank has worked hard to invest and commit to local projects, interests and clients, in addition to offering global expertise, earning themselves a reputation for financial innovation and pioneering that would benefit the local economy.

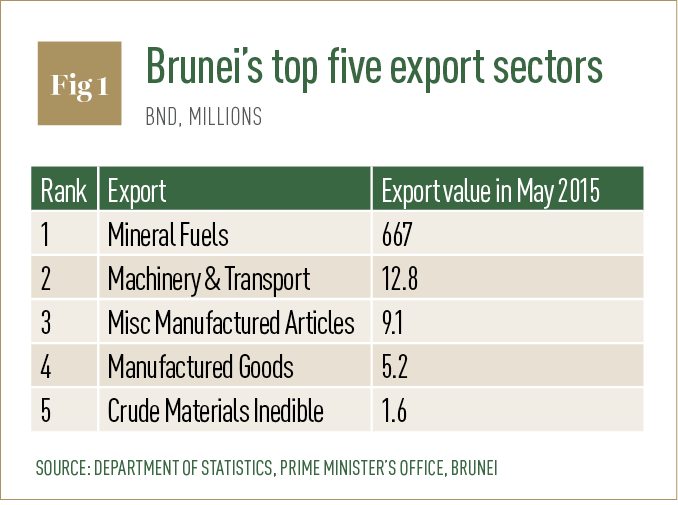

The fall in oil prices has been a mixed bag, with energy exporters feeling the pinch and losing billions in revenue, while consumers in net importer nations are all smiles at the pump. Brunei may well be a wealthy country and its government have taken steps to try to diversify its economy, but it is still a net exporter of oil and gas (see Fig. 1). Brunei relies heavily on the revenues it receives from the sector, with it accounting for more than half of its GDP. Therefore, many expected the country to struggle when the commodity’s price fell by more than half earlier this year. And while this may have slightly slowed the sultanate’s economy in 2014, its banking industry has managed to escape the effects of the commodity’s plummeting price unscathed.

The fall in oil prices has been a mixed bag, with energy exporters feeling the pinch and losing billions in revenue, while consumers in net importer nations are all smiles at

the pump

Exhibiting resilience

The resilience the country has shown is because its economy is mainly driven by government spending (see Fig. 2), according to Pierre Imhof, CEO of Baiduri Bank. “This year the government has decided to maintain the budget – and therefore the spending – at a level very close to last year’s”, he told World Finance. “For the year 2015-16 the budget has been reduced only by around five percent, so it’s very small. Of course, the income will not be at the same level as last year, so the budget deficit should be covered by part of the accumulated reserves of the country.

“So this budget remaining more or less at the same level will definitely help the domestic economy. Therefore, being a local bank with all our activities within the country, we expect that we will not suffer too much from the lower oil prices”, said Imhof.

That is not to say that the banking industry does not face challenges as a result of falling energy prices. In fact, if prices remain low for a prolonged period of time, the country, its economy and members of the banking sector will have to think of ways to adapt and adjust to this unfavourable environment.

Imhof expressed doubt over whether budget levels may be maintained should energy prices remain low and explained how the oil and gas industry – and the operators in such an environment – are likely to cut costs should this trend continue. If it does, then it may affect the private sector and could even delay some infrastructure developments by the government, admitted Imhof.

Staying competitive

Staying competitive is of course a major issue for any bank, and that often means really staying on top of the latest technological innovations, as well as offering new and exciting products and services that will entice new customers and provide a reason for existing ones to stay. Implementing all that effectively is a real challenge, but is essential for any bank looking to succeed in the modern digital economy.

“Technology is definitely an important part”, said Imhof, “but our absolute priority is to give our clients the best customer experience – whether they visit one of our branches or utilise our electronic channels”.

That is why the bank launched the first café bank concept branch in Brunei. “When our customers come to the branch, they can relax on a sofa and have coffee while they are transacting”, said Imhof. “We also want to give customers a choice. If they prefer one on one interaction, we have the branch network. If they want to go through the internet, we are also able to offer our online banking services.”

It is one of the many fresh and innovative ideas to come from the bank, with it possessing a wide array of impressive services and products. The latest of which, is the Visa payWave, allowing customers access to contactless payments.

Imhof admitted that the country’s small population makes it more challenging to embark on new technologies due to the absence of economies of scale. “However, we will definitely continue offering our clients the latest banking technology. It is a challenge, but it is also an opportunity we do not want to miss out on”, explained Imhof.

Baiduri Bank clearly understands its customers and knows how to attract their attention, but at the beating heart of any economy are small and medium-sized businesses (SMEs) and the owners that run them. And with 90 percent of private businesses in Brunei being SMEs, how Baiduri Bank chooses to serve them is crucial not only to their success, but will also contribute to the long-term economic stability of the entire country.

“First, our services – and especially financing – are customised for these clients”, contended Imhof. “Secondly, we are a local bank, so the decision making process is in Brunei. It allows us to be more flexible, and faster, taking a decision in granting a facility or in structuring financing.

“Third, SMEs need very specific financing. We have micro-finance schemes, and enterprise facilitation schemes, which we offer to SMEs in collaboration with the Ministry of Industry and Primary Resources. And these are schemes which are designed for SMEs: they are cheaper, and companies which might not be eligible to other schemes can still access financing through such schemes.”

In 2014, Brunei implemented the Local Business Development (LBD) programme in the oil and gas sector, which had a big impact on both it and the banking industry in Brunei. The programme was developed by the authorities in Brunei to encourage economic players to rely more on local resources and to develop more local content in their human capacity.

“The LBD encourages companies operating in Brunei to do more business with local banks, which has benefited banks like us”, said Imhof. “One of the characteristics of Brunei banks is having large excesses of liquidity. The banks are extremely keen to re-inject the funds back in the domestic economy by financing more projects and property.”

In its effort to develop local content, the LBD seeks organisations to employ more locals. The population of Brunei is over 400,000 out of which 28 percent are between 20 and 34 years old. The young are eager to work and contribute to the country. However the initiative needs to be done in a progressive manner over time.

Moving forward

Energy prices will always play a decisive role in the country and if they continue to remain at low-levels, drastic action will need to be taken by the government in order to reduce its reliance on oil and gas income. If that does happen it will be a very difficult time for the government, but a number of positive outcomes could arise from it, according to Baiduri Bank’s CEO.

“One positive outcome is that it may lead to accelerating economic diversification programmes in the country”, said Imhof. “And the banks will have a lot to benefit from diversification: first of all it will give them opportunities in the country. But companies in Brunei may also look for opportunities overseas, and if they do, there will be opportunities for banks to finance their clients’ activities overseas. Progresses made within ASEAN economic integration initiatives will certainly provide opportunities for the banking sector to play a wider role in the region.