Top 5

The history of Islamic finance goes back more than 1,400 years, when the general population was mostly active in goods trading. However, modern Islamic finance has seen a rapid resurgence, particularly since the mid-1970s, and today one can claim that Islamic finance is present on a global basis across all segments of the financial markets. In fact, the industry has seen tremendous growth in the past 20 years, with total assets rising from $150bn in the 1990s to exceeding the $2tn mark in 2014.

More recently, global financial centres, such as London, Singapore, Hong Kong and Luxembourg have begun to show increasing interest in serving as financial hubs for Islamic finance. This has been spurred by successes in the sukuk (bond) market, which had a particularly commendable performance last year, reaching $104bn from 630 issues at the end of October 2014. Given the impact that the industry is having, World Finance sat down with the CEO of the Islamic Corporation for the Development of the Private Sector (ICD), Khaled Al-Aboodi, to discuss how Islamic finance aims to continue its success.

What do you think the potential of the Islamic finance market is?

We can see that Islamic finance is getting more and more recognition worldwide, especially due to its social and ethical aspects and also importantly for its impact on the real economy. As the Islamic finance industry expands its outreach and becomes more mainstream across the Muslim world we will certainly see more product innovation and a reduction in transaction costs, which should result in greater depth in the various segments of the markets. With more governments recognising the added value of Islamic finance as a comprehensive financial system, which can run parallel to their conventional system, more policy attention is being paid to introducing an Islamic finance legal and regulatory framework, which should lead to better corporate governance and risk management across the industry.

$150bn

Islamic finance assets in 1990s

$2trn

Islamic finance assets in 2014

The positive demographics of the global Muslim population, which will reach 26 percent of the total global population by 2020 and of which over 60 percent are under the age of 30, will continue to drive demand for Islamic finance in terms of sophistication and product offering. I believe the industry has gained the traction and maturity to rise to a much higher level within the next few years and the growing interest of key global financial centres will further accelerate the growth and the internationalisation of Islamic finance.

What part has the ICD played in the development of Islamic finance?

ICD as the private sector arm of the Islamic Development Bank Group (IsDBG), is the premier multilateral financial organisation, which operates under the principles of Islamic finance in the private sector arena. The ICD supports the private sector of its member countries in terms of providing financing and investment and also providing advisory services in various fields of activities such as advising governments on sukuk issuances, privatisation programmes and setting up of special economic zones.

The IsDBG has been a pioneer in the Islamic finance industry since its creation 40 years ago. ICD, which was created more recently in the year 2000, has been leading the way in the private sector of many of its member countries by setting up financial institutions such as Islamic banks, leasing companies and investment companies in addition to providing term financing, all in accordance to the principles of Islamic finance.

Moreover, recognising the acute shortage of properly qualified Islamic finance professionals and its negative impact on the industry, ICD, three years ago, launched a special programme called the Islamic Finance Talent Development Programme with a view to develop and fill the gap in terms of the required human capital to take the Islamic finance industry forward on a strong footing.

Can you expand on ICDs key achievements to date?

ICD is now in its 14th year of operation and recorded another year of positive results in 2013 and is also expecting positive results in 2014. As a multilateral development financial institution, we do not measure our success and achievements only in financial terms, but most importantly in terms of the developmental impact of our interventions in our member countries.

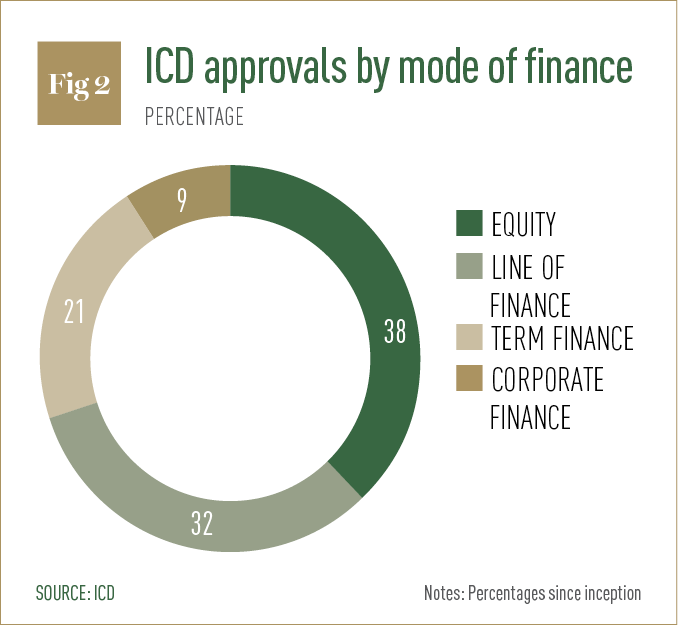

I can confidently claim that ICD has been able to continue providing effective services and support to its member countries despite the challenges arising from the broader socio-economic environment in which it is operating. In addition to the enduring negative effects of financial crises, some of our member countries are facing continued political turmoil and armed conflicts. Nonetheless we remain focused on our mandate to promote the development of the private sector in our member countries while observing our short-term priorities to ensure that ICD remains effective and relevant towards its long-term objectives. Over the last 13 years ICD has expanded its geographical reach across the world (see Fig. 1) and its accumulated gross approvals at the end of 2013 stood at approximately $3bn allocated in various modes of finance (see Fig. 2) to over 300 projects across 25 countries.

In line with its core strategy, ICD has been focusing more resources in the financial sector with the objective of fast tracking funds to the small- and medium-sized enterprises (SME) sector. In addition to providing lines of credit to local banks in its member countries for onward financing of SMEs, ICD as part of its overall strategy has been setting up leasing companies, investment companies and Islamic banks to act as its ‘channels’ to reach a greater multitude of beneficiaries.

ICD has been active in setting up funds to improve SMEs access to term financing and equity investments. As an example, ICD established the first SME investment fund in Saudi Arabia, a SAR 1bn ($266.5m) quasi equity and debt sharia compliant SME fund. This fund will invest in targeted SMEs showing high-growth potential for contributing substantially to job creation among the youth and with a strong developmental impact to ensure overall social and economic stability.

What products and services do you offer?

As mentioned earlier, ICD was set up as the private sector arm of the IDB Group to focus primarily on private sector development with a view to creation of employment and reduction of poverty in its member countries. ICD offers a wide array of products and services that supports the establishment, expansion and modernisations of private enterprises. ICD intervenes through various modes of financing including equity participation and quasi equity, term financing, corporate financing, and various types of advisory services including technical assistance.

What is the ICDs role in the development of the private sector?

The private sector is unanimously recognised as a critical driver of sustainable economic development that drives economic growth for the improvement of people’s living conditions.

ICD is the leading multilateral financial institution offering a multitude of Islamic finance investment and financing products and continues to play an important role for the development of the private sector in its member countries. ICD has also been successful in mobilising resources to bring highly needed investments in certain member countries through the comfort it provides to other foreign investors by its own participation in these projects. ICD also offers advice to governments and private sector organisations to encourage the establishment, expansion and modernisation of private enterprises, the development of capital markets and the adoption of best management practices.

What is ICDs strategy and how do you see it changing in the years ahead?

I believe that increased liberalisation and greater awareness of Islamic banking in non-Muslim countries and the developments in the Islamic capital markets will certainly lead to greater adoption of Islamic finance across the world.

We plan to continue our successful partnership with our member countries and expand our activities into new regions. We are also directing our efforts to expanding our partnerships with non-Muslim and non-member countries, as a means of supporting the internationalisation of Islamic finance.

We will continue our efforts to support and improve the living standards of people in our member countries through the development of the private sector by ensuring that Islamic finance remains inclusive and accessible to all, particularly the lower income groups and small businesses. I strongly believe that it is only by bringing the financially underserved population into the economic mainstream that we can truly contribute towards more sustainable and equitable economic growth, which is at the heart of Islamic finance.