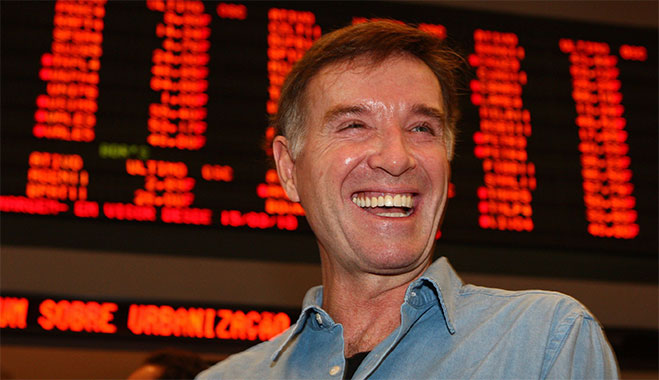

“I’m not bragging. It’s just a consequence of all the things that we have done. Just look at the assets. Jesus, by 2015 we will be making $10bn. Between 2015 and 2020 that will double, or triple. And those are discounted numbers I’m giving you.” Eike Batista’s modesty might not have shone through in his now infamous interview with the Sunday Times in March 2012, but his confidence certainly did. He was then Brazil’s richest man, the fourth richest person in the world and on a mission to the top. What a difference two years make.

In the intervening time, Batista lost most of his $30bn and tumbled right off any rich list he once appeared on. Batista’s white-knuckle ride of ostentation and loss culminated with OGX, his once celebrated oil-and-gas company and the cornerstone of his empire, filing for bankruptcy this past November, after missing $45m worth of payments to bondholders.

Though he still heads another four listed companies in energy, ship building, mining and logistics, Batista’s unconventional set-up and management style means that even the profitable parts of his sprawling businesses are likely to face the axe as a direct consequence of OGX’s failure.

Building something from nothing

Batista has been a ‘celebrity millionaire’ in Brazil for the past 30 years. Known for his extravagant taste, exuberant (and public) family life, and unrepentant ambition, Batista became the face of Brazil’s emergence as an economic powerhouse over the last two decades. In many ways Batista’s success was symbolic of what Brazil could be, with just a little bit of hard work.

His father was a prominent businessman who once headed Vale do Rio Doce and served as Minister for Mines and Energy in the 1960s and then the 1980s, but his children were raised by his estranged wife in Germany. As the youngest, Eike abandoned an engineering degree in Aanchen to try his luck in Brazil, and by the age of 25 he had made $6m by buying and selling gold. He married a model, bought a very big boat and started growing his business.

Batista made his real money in mining in the 1990s. Since 2004 he listed five successful companies under the EBX (Eike Batista X) umbrella: MPX in energy generation; MMX in mining; LLX in logistics; OSX in shipbuilding; and of course OGX. Batista once boasted to Brasil Econômico, that “the ‘X’ represents multiplication”, referring, of course, to his assets.

Batista’s troubles can be traced back to the launch of OGX in 2008, though they would only reveal themselves much later

The companies, excluding OGX, and a handful of other international holdings including a mining operation in Colombia, were virtually multiplying in size and value each month for much of the mid to late 2000s. In 2009 alone, EBX shares were up by 195 percent; LLX had gained 500 percent and Batista’s reputation as Brazil’s golden boy was solidified.

Batista’s troubles can be traced back to the launch of OGX in 2008, though they would only reveal themselves much later. The oil and gas company was launched and listed on the basis that it would explore prospects around Brazil, but without any actual fields in operation. It was always a risky proposition, but Batista had assembled a reputable team of experts behind his project, all ex-Petrobras with a wealth of experience in drilling in Brazil.

Batista was riding the slipstream of the discovery of Brazil’s enormous ultra-deep-sea crude oil reserves, known as the Pré-Sal region off the southeast coast of the country. OGX’s IPO raised $3.7bn and was Brazil’s biggest ever IPO at the time.

But in 2012, news broke that OGX was slashing production in what had been touted as its biggest oil asset off the Rio de Janeiro coast. It soon became apparent that for all of Batista’s skilled sales pitch, there was nothing supporting the hype of OGX. When the company announced it would be winding down production by 2015, it was producing 10,000 barrels of crude a day – barely a fifth of what it had promised in the IPO prospectus five years earlier. Shares tumbled by 99 percent and bonds were being traded at eight percent of their face value. However, that was just the beginning of Batista’s problems.

In the five years between OGX going public and then going bust, Batista seemed to be caught up in what can only be described now, with the benefit of hindsight, as unbridled megalomania. He had extended himself from energy production to flashy – and expensive – entertainment and hospitality ventures. At one point an EBX subsidiary was bidding for the Maracanã stadium concession, had won the contract to renovate and run a historic hotel in downtown Rio and was running the Rock in Rio festival, a ten-day party that brings the biggest names in pop music to Brazil.

These showy enterprises not only lost Batista a lot of money when it eventually became apparent they were being frightfully mismanaged, but they also lost him a lot of standing with the Brazilian public, who stopped thinking of him as an aspirational figure and started seeing him as something of an ostentatious show-off.

Overestimated assets

As OGX started to unravel, Batista’s almost risible capitalisation strategy became apparent; and the ultimate demise of EBX became a chronicle of a death foretold. Batista had relied heavily on government support, not only in terms when bidding for concessions, but also in investment through the Brazilian Development Bank (BNDES).

As of October 31, the bank stood to lose up to BRL 6bn, around $2.61bn of direct investment and financing of EBX projects. EBX’s main companies were all built upon the same foundations: the opportunity to profit from Brazil’s exuberant mineral reserves by investing in the infrastructure that the government would be unable to build itself.

Batista was building ports, ships, energy infrastructure and mines; all of his companies were interconnected, MMX’s mining products would be shipped from LLX’s multi-use port, which would also be used as an oil hub for OGX’s products, and so on. When OGX and its billions of dollars worth of debt came crashing down, it dragged down the whole lot of them.

He built a $30bn house of cards by persuading investors, banks and the Brazilian government that his superstructure of companies could be the answer to all of Brazil’s infrastructure needs

Batista started his business life peddling insurance door-to-door, and his salesmanship is undeniable. He built a $30bn house of cards by persuading investors, banks and the Brazilian government that his superstructure of companies could be the answer to all of Brazil’s infrastructure needs.

He sold a dream. However, by 2012 it was obvious that the man lacked the management skill to make that dream function past the sales pitch. Batista had not only built his conglomerate in such a way that his main companies relied heavily on each other to succeed, but he also severely leveraged OGX, by far his most ambitious enterprise, on his other, already successful companies. When OGX announced it was suspending operations, Batista was leveraged up to his ears.

In June, Batista, seeing EBX on the verge of collapse, took out a full page editorial in the O Globo and the Valor newspapers. Though described by the local media as a mea culpa of sorts, in which he confronted headfirst the perception that he benefited “from a rampant wave of capital building, that [he surfed] on a wave of an inflated market, that without any apparent reason, offered him a blank cheque with a few billion with which to play at being an entrepreneur.”

However, though he admitted this is how he has come to be seen by the market and the public, the editorial did nothing to disabuse any one of those opinions. Batista boldly placed the blame for OGX’s shortcomings on the ranks of executives he had drafted in from other oil and gas companies to help him develop the company, who he all but accuses of having over-inflated expectations with their optimistic analysis of the market and the company itself. “I was as surprised as any of my investors, collaborators and the market,” he wrote, referring to the losses accrued by OGX.

“More than anything I ask myself where I have erred,” he continued. “What should I have done differently? The first issue is probably linked to the financing model I chose for my companies.” Batista suggests that by relying on the stock market he condemned his companies to failure. He admits to being too eager: “If I could turn back time, I would not have resorted to the stock market. I would have structured private equity that would have allowed me to build the companies from zero and develop them each over 10 years.”

Though Batista is not wrong when he identifies his financing model as a major factor contributing to the undoing of his empire, his inability to take responsibility over the mismanagement of his many investments is worrying. Though he has managed to sell off the least damaged of the ‘X’ companies – LLX was bought by EIG Global Energy Partners, MMX was sold to Trafigura, a Dutch commodity trader and Mubadala, Abu-Dhabi’s sovereign wealth fund, and MPX was bought by E.ON and renamed Eneva. The Colombian coalmines are also being sold. But there are billions of dollars in debts to service, and the rest of his smaller enterprises continue to struggle.

Throughout the collapse of OGX and the subsequent quartering of EBX, it became increasingly apparent that for all of Batista’s confidence, his enthusiastic showmanship, his jolly arrogance and ostentatious lifestyle, deep down he remained the door-to-door peddler of his youth. He was a good salesman, but his shortcomings as manager and executive made his downfall.

He was a good salesman, but his shortcomings as manager and executive made his downfall

Batista is now facing a lengthy legal struggle against his creditors as he tries to limit losses. EBX is on full damage control mode now; they have filed a number of suits with the Brazilian justice system in an attempt to stay off bankruptcy and avoid trouble with the creditors, all of which remain unresolved.

Batista’s personal fortune, once estimated at $34bn, has dwindled to around $200m; three of his private jets and a helicopter have been sold. It is unclear how Batista will manage to extricate himself from the tangle of debts and collapsing contracts he has woven around himself, but it will take years before he can truly move on from this disaster. Perhaps he should have taken note of the old maxim: Jack of all trades, master of none.