The UK’s highly competitive mobile telecom industry is set for a major shake up after news emerged that O2, the country’s biggest provider, is set to be purchased by Hong Kong’s Hutchison Whampoa. The potential deal, worth £10.25bn, would see the Hong Kong firm’s Three network, currently the smallest in the market, combine with the market leader.

Talks over the sale of O2 by Spanish parent company Telefónica have been on-going for the last two months, with discussions with BT coming to an end in December. Hutchison’s offer is thought to be worth around £9.25bn of cash, with an additional £1bn coming later. According to the Hong Kong firm, talks have been underway for a number of weeks and they are now in exclusive negotiations.

Another merger in the UK telecoms industry currently being discussed is the £12.5bn purchase of EE by BT

Another merger in the UK telecoms industry currently being discussed is the £12.5bn purchase of EE by BT, which will further shake up the market. The UK’s media regulator, Ofcom, is thought to have concerns over the prospect of further consolidation the industry. Traditionally it has favoured a minimum of four major market players in the industry so that consumers are offered competitive prices. Were the O2 deal to go ahead, the market would be cut down to three major players – O2/Three, Vodafone and EE.

With BT moving back into the mobile space – it previously owned O2’s predecessor Cellnet until selling to Telefónica in 2005 – the industry is set to have a number of big players competing for customers. Vodafone, the industry’s third largest firm, has been strengthening its operations in recent months across Europe, while trying to recapture the market dominance it had during the last decade.

EE, with 25 million customers, is seen as the market leader in the 4G space, and will be greatly boosted by joining forces with BT’s network. However, both firms will be particularly concerned about the market leader swallowing up Three’s eight million customers, who are traditionally around the cheaper end of the market.

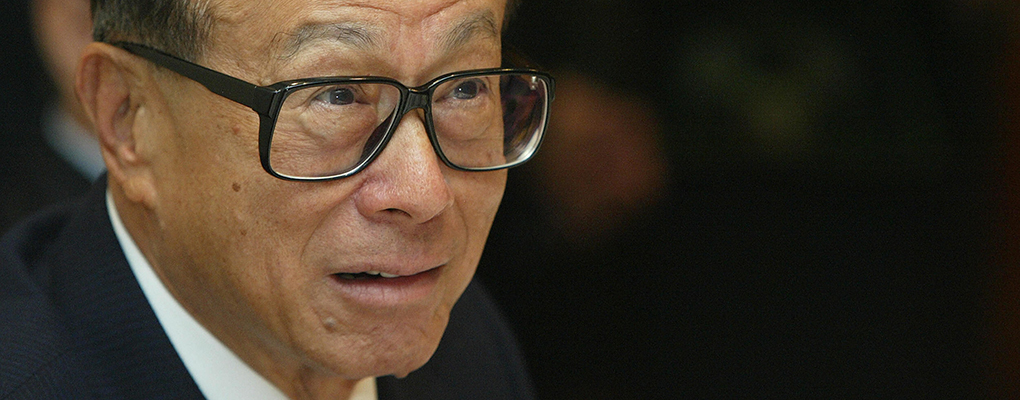

Hutchison Whampoa is owned by Asia’s richest man Li Ka-shing, who has been actively looking to build up his operations across the world. While there are concerns over the deal, Hutchison’s Group Finance Director, Frank Sixt, believes that EU regulators have approved reducing the number of players in an industry in the past. He told the BBC, “The European Commission has taken a positive view of four-to-three consolidations of mobile in three cases now…and we believe that the precedents that they have set in those transactions will apply for this transaction.”