Last year, the largest nuclear power builder in history went bankrupt. Japanese conglomerate Toshiba’s prolific subsidiary Westinghouse filed for bankruptcy after revealing billions of dollars of cost overruns on its US construction projects. At the start of 2018, Toshiba agreed to sell the business for $4.6bn.

Despite technological advances, the cost of nuclear power tends to increase due to the high price of taking care of ageing reactors

The high-profile sale followed the French Government’s €5.3bn ($6.2bn) bailout of state-owned nuclear company Areva, which went technically bankrupt after a cumulative six-year

loss of $12.3bn.

These distress signals were noted in the 2017 World Nuclear Industry Status Report, which claimed the debate on nuclear power is over. “Nuclear power has been eclipsed by the sun and the wind,” the report’s forward read. “These renewable, free-fuel sources are no longer a dream or a projection – they are a reality [and] are replacing nuclear as the preferred choice for new power plants worldwide.”

But even while confidence in the industry erodes, strident nuclear advocates still insist the technology is a fundamental ingredient in the global energy mix, providing vital zero-emission, base-load power.

Powering down

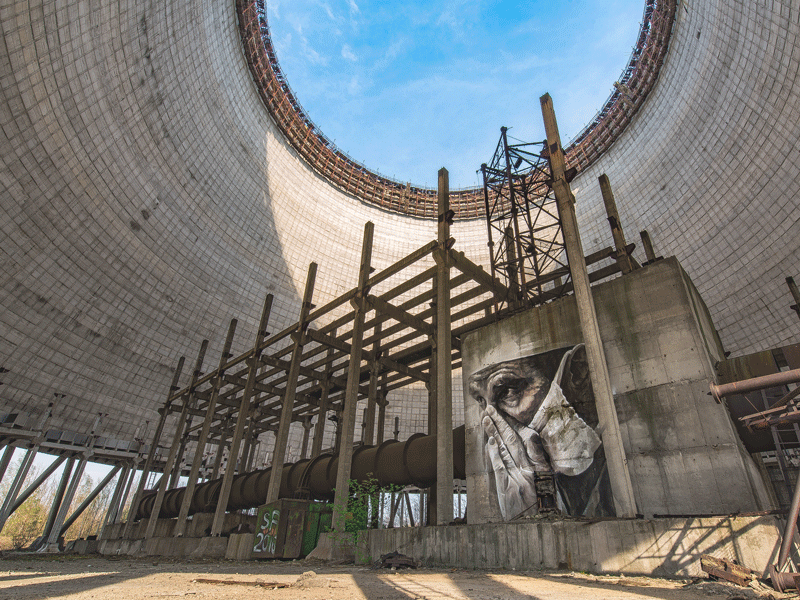

The nuclear industry has been shaped in many ways by its biggest disasters: the catastrophic Chernobyl tragedy in Ukraine is considered to be the worst nuclear accident in history, in terms of both cost and casualties. In 1986, one of the four nuclear reactors at the power station exploded, spewing radioactive material into the atmosphere. Decades later, there is still no accurate measure of how many people have indirectly died from the exposure.

$200bn

Estimated cost to date of the Fukushima nuclear plant disaster

$630bn

Estimated eventual cost of the Fukushima nuclear plant disaster

90%

Drop in real price of solar photovoltaic power from 2009-2016

50%

Drop in real price of wind power from 2009-2016

9GW

Increase in global nuclear capacity in 2016

55GW

Increase in global wind capacity in 2016

75GW

Increase in global solar capacity in 2016

126

Number of nuclear reactors operating in EU member states

25%

Proportion of electricity generated by nuclear power in the EU

Then, in 2011, a 9.0-magnitude earthquake off the coast of Japan triggered a 46-foot tsunami that hit the Fukushima nuclear plant. The event led to the leakage of radioactive materials, and the plant was shut down. Six years later, the total official cost estimate for the catastrophe has reached $200bn, though it could rise to as much as $630bn according to independent estimates.

These incidents have cast a shadow over the sector. In the years since, new nuclear designs have aimed to improve safety features while maintaining low costs. But despite this, the frequency with which cost overruns and delays occur means nuclear projects are still often deemed too risky for private investors.

Construction delays are a big factor behind rising costs. According to the 2017 World Nuclear Industry Status Report, 37 of the 53 reactors under construction in mid-2017 were behind schedule. Eight of those projects have been in progress for a decade or more, and three of those have been under construction for more than 30 years.

As recently as July, Électricité de France’s (EDF’s) flagship nuclear project in Flamanville, which is already seven years behind schedule, was set back by another year over piping weld issues. The ‘quality deviations’ found in 33 welds at the European Pressurised Reactor (EPR) would also cause costs to swell by a further €400m ($465m). The cost of the project now sits at a grand total of €10.9bn ($12.7bn), more than three times the original budget.

Flamanville is one of three new EPRs currently being built in Western Europe. The region’s first new nuclear power station in 15 years, Finland’s Olkiluoto 3, was supposed to be completed in 2009. After numerous delays, it is now expected to be finished in May 2019. Meanwhile, the 3.2GW Hinkley Point C reactor in Somerset is expected to become the UK’s first new nuclear power plant in more than 20 years. It is already expected to be around £1.5bn ($2bn) over budget and more than a year behind schedule.

Yves Desbazeille, Director General of FORATOM, the trade organisation for Europe’s nuclear power producers, told World Finance that delays in major construction projects “are relatively common and difficult to predict”, whether in the nuclear sector or elsewhere.

“Nevertheless, we believe that lessons learned from the projects which are currently being developed in Europe will allow us to avoid these risks in the future,” Desbazeille added.

Likening nuclear power to that of a living organism, however, Mycle Schneider, the lead author of the World Nuclear Industry Status Report, told World Finance the industry was like a “dying species” due to the obvious reduction in new nuclear project launches in recent years.

This is seen clearly in the International Energy Agency’s (IEA) annual World Energy Investment report, updated in July, which found that nuclear investment is falling fast. The amount of money funnelled into nuclear power nearly halved in 2017, dropping by 45 percent as fewer new plants came online. New nuclear capacity was hit particularly hard, falling by around 70 percent to the lowest in five years as a growing slice of investment was put towards upgrades for existing reactors. Moreover, the growing popularity of renewable energy must be considered, according to Schneider: “To nuclear power, it’s like an invading species to the living organism.”

Renewables charge ahead

The economics of renewable power generation has transformed in the past five years, with costs plummeting to record lows due to the technology’s exceptional ‘learning rate’. A learning rate is the drop in the initial cost of construction as technology improves over time. The quick decline in the cost of renewables took the industry by “total surprise”, Schneider said.

For power generated by a solar photovoltaic (PV) system, that means real prices have plunged by 90 percent between 2009 and 2016. The real price of wind power, meanwhile, fell by 50 percent.

At the same time, nuclear power has presented a negative learning rate: despite technological advances and years of study, the cost of nuclear power tends to increase due to the high price of taking care of ageing reactors.

Nuclear power emits 30 times less carbon dioxide than natural gas, 65 times less than coal and three times less than solar energy

Politicians can’t pretend new nuclear projects are a viable economic option, Schneider said: “There is no market anymore in the world where new-build [nuclear reactors are] economic under market economy terms.”

Renewable energy is not only threatening new nuclear projects; even existing nuclear power, which costs an average of $35.50 per MWh, was higher than recent renewable energy auctions in a number of countries, where prices have fallen to all-time lows of below $30 per MWh.

But Desbazeille said the issue of comparing costs was more complex. Citing a recent report by the OECD’s Nuclear Energy Agency titled The Full Costs of Electricity Provision, he said the price of electricity in today’s market does not include all the costs that must be taken into account when comparing different energy sources, such as grid-level costs, land-use charges, security of energy and electricity supply, or employment generated in the electricity sector.

Whatever the cost comparison, it appears adding solar and wind power to the grid is more common at the moment. In 2016, global nuclear capacity increased by just 9GW, while solar capacity jumped by 75GW and wind notched a 55GW increase.

Comparing the data since 2000 presents an even starker image. In the 16 years measured by the World Nuclear Industry Status Report, countries around the world added 451GW of wind energy and 301GW of solar energy to power grids, dwarfing an increase of just 36GW for nuclear.

The emissions race

Although the 126 nuclear reactors operating in 14 EU member states generate more than a quarter of all electricity in the EU, and nuclear sources still accounted for close to 30 percent of all electricity production in the eurozone as recently as 2015 (see Fig 1), many governments are beginning to turn their backs on nuclear power.

In March, Belgium agreed to shut down the country’s seven nuclear reactors by 2025, and Germany has been working since 2011 to phase out its nuclear reactors by 2022. In a referendum in 2017, Switzerland also voted to gradually eliminate its nuclear reactors.

The change is even occurring in France, which is the second-biggest user of nuclear power after the US. President Emmanuel Macron’s election campaign in 2017 included a promise to cut nuclear power generation from more than 70 percent of the country’s energy mix to 50 percent.

But nuclear power accounts for almost half of the EU’s low-carbon electricity generation, and in some cases retiring nuclear power stations has undone some of the bloc’s work to reduce carbon emissions. According to FORATOM, nuclear power emits 30 times less carbon dioxide than natural gas, 65 times less than coal and even three times less than solar energy. The IEA found that the decline in Europe’s nuclear generation since 2010 has offset over 40 percent of the growth in solar PV and wind output across the continent. Desbazeille told World Finance the objectives of the Paris climate accord – the 2016 agreement signed by nearly 200 countries to reduce carbon emissions – “cannot be achieved without nuclear power”.

Due to the complexity of the situation, the UK has been urged to take a measured approach. The UK has sought to build as many as six new nuclear plants in the coming years to replace ageing coal and nuclear reactors. However, in July, an independent advisory body warned the government not to rush into any further support for new nuclear power stations due to the falling cost of wind and solar power. After Hinkley Point C, the National Infrastructure Commission (NIC) suggested the government should agree on support for only one more nuclear plant before 2025.

The NIC said an electricity system mainly powered by renewable sources of energy would be the “safest bet” in the long term, as wind and solar power have a much lower risk profile.

Sir John Armitt, the NIC’s chairman, told World Finance the problem with nuclear is that it is a “very, very complex system”. While renewable costs can be reduced through technological simplifications, nuclear projects have a “tendency to constantly be concerned about safety”, Armitt said. That means a long, uphill struggle for design and licensing approvals and little opportunity for cost reductions along the way.

Armitt worked with the contractor on the UK’s Sizewell B nuclear power station, and he remembers standing in the midst of construction a couple of years before commissioning and thinking: “There must be a cheaper way to generate electricity than this.”

While the NIC’s prediction might not be absolutely certain, Armitt said: “We’ve got time in the 2020s to pause and have a low-regret solution, which is to not rush ahead with nuclear while we see what continued developments take place that could potentially give us a renewable future, rather than a nuclear future.”

According to Schneider, a government that continues to invest in new nuclear power after looking at the hard data is not focused on the economics of energy anymore: “We’re talking about investments that are done for different reasons.”

He explained: “A third of the investment for Hinkley Point C comes from China… It’s geopolitics. It’s to get a foothold in a strategic sector in a country like the UK and take it as a platform.” Plus, in a country like Iran, nuclear science still has “this perfume of exquisite, exclusive

top science”.

China’s waning nuclear interest

By a wide margin, China is currently the global leader in the construction of new nuclear plants. In fact, for three years in a row, global electricity generation from nuclear power would have decreased if China were removed from the picture. By 2030, the IEA expects the country to overtake the US as the world’s top generator of nuclear power.

Much of the nuclear debate is powered by opinions, but looking at the hard data, it’s clear that the industry is in a slow and inevitable decline

Of the 10 reactors that started up globally in 2016, half were located in China. Meanwhile, nearly 40 percent of the total reactors currently in construction are Chinese. However, China has not launched a new construction of a commercial reactor since December 2016.

The country had planned for 58GW of total nuclear capacity to be in place by 2020, but having failed to get 30GW of new plants under construction by 2018, China’s lead in the field of nuclear power may be slipping.

What’s more, even in this hub of nuclear activity, renewable generation is moving even faster. As of July 2017, China had 37 operating nuclear reactors with a total net capacity of around 32GW. In 2017, however, the country added a whopping 53GW of solar power.

“To illustrate the speed with which things change, and [which] the invading species is taking over, if you only go back five years in 2012, Germany was the world record holder in the addition of [solar PV] with 7.5GW,” Schneider said. “Now it’s China with [53GW] five years later. The speed is just unbelievable.”

The return of small reactors

One often-cited glimmer of hope for the nuclear industry is in small modular reactors (SMRs). These shrunken-down nuclear reactors generate electrical output of between 50MW and 300MW on average, compared with the generation of 1,000MW or more from a conventional reactor, but it is unlikely they will be commercially available before 2030.

Proponents say SMRs will be cheaper and safer than conventional nuclear plants, and will be capable of competing with solar and wind power. Desbazeille said SMRs were a “game changer” that could put Europe back at the forefront of nuclear technology.

“We often hear about the ‘Airbus of this or that’, but an ‘Airbus of SMRs’ at EU level would make sense as it would fit perfectly into what Europe can be strong on: integration of complex systems, manufacturing and industrial optimisation. This is exactly what the Airbus success story is built on,” Desbazeille said.

Much of the nuclear debate is powered by opinions and estimates, but looking at the hard data, it’s strikingly clear that the industry is in a slow and inevitable decline

But while SMRs are purported to be the key to transforming the nuclear sector, history has painted a troubling picture: SMR designs have been in the works for decades, but none have reached commercial success. In fact, Westinghouse worked on an SMR design for about a decade, but the project was abandoned in 2014. At the time, then-CEO Danny Roderick said: “The problem I have with SMRs is not the technology, it’s not the deployment – it’s that there’s no customers.”

A number of companies continue to work on new designs, however. US firm NuScale Power plans to develop an SMR to re-establish the country’s leadership in nuclear technology. The design is currently under review for approval by US regulators. While NuScale is seen as one of the firms closest to commercialisation, it may be too late by the time the arduous process of securing approvals is completed.

Therefore, by the time SMRs are ready for mass deployment, the energy debate may already be over. “Look at what happened over the past five years,” Schneider said. “But can you imagine what will happen in the next 10 years? This is going to be a completely different world.”

“It’s a very seductive idea,” Armitt added, but he feared the modularisation idea might not be as easy to deliver as it sounds.

Although SMRs have been talked about for decades, the progress made so far has been tiny. New technologies in the nuclear sector take a huge amount of time to develop – just look at the struggle to build EPRs in Europe. Plus, opting for a small design cuts out the economies of scale, or the cost advantages that come about due to increasing the size of a project. This is something nuclear projects often rely on.

A report by researchers at Harvard University, Carnegie Mellon University and the University of California, San Diego concluded that in the absence of a “dramatic change in the [US] policy environment”, a convincing case for a domestic market for SMRs is difficult to make.

Much of the nuclear debate is powered by opinions and estimates, but looking at the hard data, it’s strikingly clear that the industry is in a slow and inevitable decline. China’s plans to become a nuclear powerhouse have been overshadowed by its huge investments in renewable energy – in fact, the number of new construction starts (see Fig 2) has fallen around the world as stubbornly high costs and complex designs make new nuclear a hard sell.

Even in spite of nuclear power’s role in reducing carbon emissions, the potential safety issues and environmental impact of a meltdown are too big to ignore. With the cost of renewable and battery technologies expected to continue falling, wind and solar power appear to be the next golden opportunity.