The deal marks Philips’ biggest healthcare buyout since it acquired sleep and respiratory product maker Respironics in 2008.

Volcano is the leading company in the image-therapy industry, which is worth around $400m according to Philips. The firm manufactures products such as catheters, which allow blood flow to be measured without the need for invasive surgery.

The company plans on boosting its spending on pharmaceuticals technology

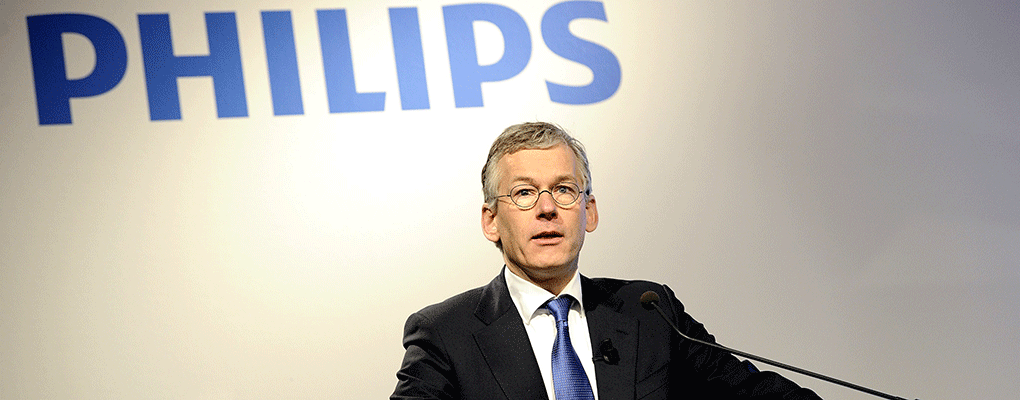

Frans van Houten, Philips CEO, said the acquisition would boost the company’s R&D and “accelerate the revenue growth for our image-guided therapy business to a high single-digit rate by 2017”.

He added that non-invasive solutions offer wide-scale advantages. “Image-guided therapies provide significant benefits for healthcare systems and patients, including reduced patient trauma, shorter recovery times and hospital stays, and lower costs.”

Scott Huennekens, Volcano President and Chief Executive Officer said the deal would also help strengthen Volcano’s proposition. “This transaction will be beneficial for our shareholders, customers, partners and employees,” he said. “There is a large and growing global market opportunity for image-guided therapies, and as part of Philips, we gain the scale and resources needed to accelerate our goals.”

Philips has been expanding its healthcare sector over recent years, with revenues from the business hitting €9.58bn and accounting for 41 percent of all sales in 2013. The company plans on boosting its spending on pharmaceuticals technology, which currently only accounts for five percent of its healthcare business.

The firm is looking to further bolster the division as it shrinks its formerly diversified portfolio. It announced earlier in 2014 that its 123-year-old lighting arm would be spun off to form a separate business, putting an end to the conglomerate structure which has characterised the company for over 100 years.