Sanctions: the financial front line

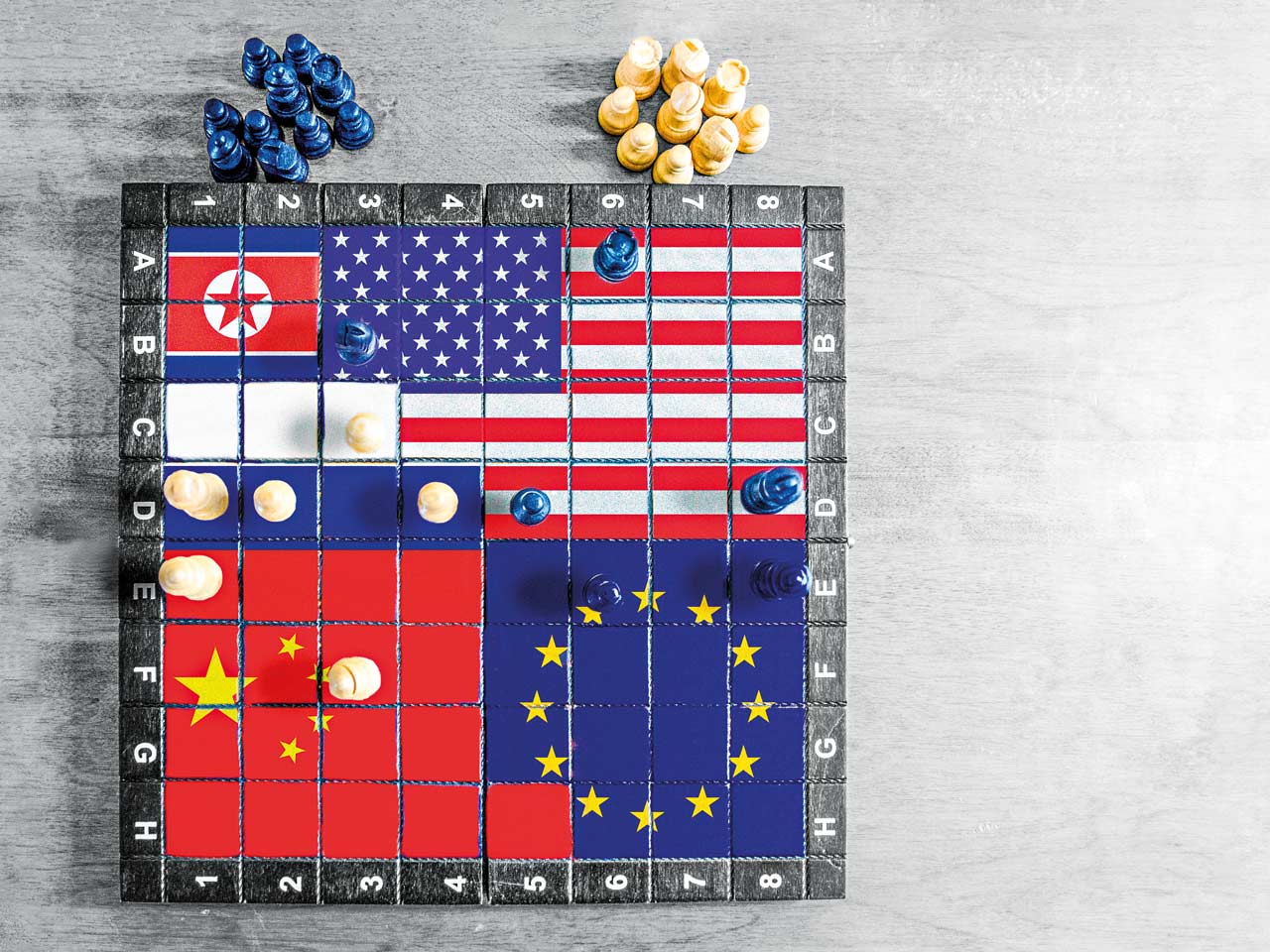

As geopolitical tensions surge, financial institutions find themselves grappling with an increasingly intricate web of international sanctions. With regulators tightening their grip, the stakes are higher than ever for those navigating this treacherous terrain

The tidal wave of geo-political volatility that has surged around the world in the last decade has propelled financial institutions into the frontline. Many were unprepared and have paid a heavy price in terms of fines and reputational damage. This has forced the sector onto a war footing, with armies of new experts recruited to help guide them through the increasingly complex battlefield of international sanctions.

Some of the fines are eye-watering (see chart) and all the signs are that they will be getting larger and strike deeper into the complex worlds of insurance, banking, trade financing and investment. The number, scale and breadth of sanctions make this a fraught area, says Oliver Brifman of Miami-based card payments business eMerchant Authority: “The key risks for financial institutions regarding sanctions include regulatory complexity, third-party risks, geopolitical uncertainty, indirect exposure, and reputational risk. With over 11,632 sanctioned individuals and 5,935 entities across the US, EU, Canada and Australia, the regulatory environment is complex, and institutions must navigate it carefully to avoid penalties.”

There may be thousands of sanctions in place but regulators around the world have been stung by criticism of the ineffectiveness of some of their sanctions, especially the numerous ways in which Russia evades the oil price cap, although this new determination to tighten the sanctions noose around Russia extends beyond Russian oil. Serious questions are being asked about how so many western manufactured goods are finding their way into Russia through countries friendly to the Putin regime. Trade finance, insurance, foreign exchange management and banking are all in the firing line.

With the focus moving from following the oil to following the money, financial institutions can expect some tough questioning from regulators. The recent criticism of the UK Treasury and its Office of Trade Sanctions Implementation (OTSI) for its poor record in prosecuting sanctions breaches by Sir William Browder, who heads the Global Magnitsky Justice Campaign and is a longstanding critic of Putin’s Russia, is likely to push the UK to take tougher action: “There seems to be both a resource problem and a culture problem when it comes to prosecuting people for economic crimes or sanctions evasion here,” he told the BBC, adding that the UK “was one of the most lax enforcers of these types of laws.”

This situation is not likely to last much longer, as the UK government injected £50m into the OTSI budget earlier this year. Watch this space, says US lawyer John Smith from Morrison Foerster: “The UK government has indicated it expects to catch up rapidly and that we should stay tuned for some bigger enforcement cases coming there but we have not seen them yet. I think it is not a lack of will when it comes to the UK, it is a lack of the experience getting them through the government channels.”

World police

While negotiating sanctions against Russia has forced its way into the day-to-day monitoring of transactions in a wide range of financial institutions since Russia launched its invasion of Ukraine in February 2022, it is by no means the only part of the world that presents a complex sanctions challenge.

The complexity of sanctions lies in their rapid evolution and the extra-territorial nature of US policies

The Middle East has long been a part of the world where sanctions have been used to isolate regimes such as Iran, and the rapidly escalating conflict between Israel and Hamas, Hezbollah and Iran is set to trigger a new round of sanctions. Israel’s attacks on branches of Al-Qard Al-Hassan, a financial institution sanctioned by the US since 2007 because of its links to Iran and Hezbollah, in Beirut on October 20 are an example of how the sanctions war can meet the brutal reality of military conflict. It might be an extreme example but nevertheless it is a reminder of how complex and intertwined geo-political risks are.

The US has had tough sanctions against Cuba in place for decades and periodically imposes – and relaxes – sanctions against some of its Latin American neighbours as friendly and unfriendly regimes come and go. The US is also very hot on clamping down on organised crime, especially the international drugs trade. HSBC found out how serious they are about this in 2013 when it had to pay $1.3bn for conducting transactions on behalf of customers in Cuba, Iran, Libya, Sudan and Burma, all of which were on the sanctions list. Federal authorities also alleged that HSBC helped to launder around $881m in drug proceeds through the US financial system.

And then there is China. There are already several sets of sanctions against China, mainly imposed by the US but some by the EU, but they are nothing compared to what could come hurtling towards financial institutions facilitating trade with China if the aggression towards Taiwan escalates, or the numerous territorial disputes in the South China Sea get out of hand. The determination of the Chinese government under Xi Jinping to make this the Chinese century has meant that China has embedded itself deeply into the world economy. Contemplating the rapid imposition of the sort of sanctions that came in the wake of Russia’s invasion of Ukraine sends shivers down the spines of global businesses and their financial backers. It would be brutal, disruptive and almost as damaging to those countries that might impose sanctions as it would be to China.

Fear of the potentially catastrophic consequences of escalating sanctions wars does not mean governments are going to stop reaching for them anytime soon, says David Chmiel, managing director of Global Torchlight, a geopolitical analysis and advisory firm: “I think it is important to understand why sanctions are now in many ways the largest arrow in the quiver. The first is purely geopolitical, which is if you look at polling data, populations around the world are still hugely reluctant to see military responses to foreign policy crises. Just look at polling around getting involved directly with Russia over Ukraine, as an example, in the US and Europe, UK and elsewhere.”

Chmiel continued: “That is combined with the fact that for all that we can talk about how much globalisation is being unwound, there are all of these economic and financial links that are in place that give governments the tools to leverage them when there is pressure to respond, but when there is a reluctance to go with the kinetic military response. So that is why sanctions have just come front and centre.”

Currency of trust

“There is also a third element that we should take into account in all of this and that is the colossal trust deficit that currently exists. The public are still hugely distrustful of institutions, be it business, be it government. There is very little political capital to be lost in imposing sanctions on business because the public do not trust financial institutions in the wake of the global financial crisis. Sanctions are a way for governments to shift cost and risk in foreign policy crises to the private sector,” Chmiel told World Finance.

A key risk for financial institutions is inadvertently facilitating transactions that violate sanctions

The message is simple: financial institutions are in the firing line and likely to remain so. The key player is the US Treasury Department’s Office of Foreign Assets Control (OFAC) which has long lists of companies and individuals that are subject to sanctions and, crucially, extends its reach beyond US businesses, known as extra-territoriality.

This has caught out many institutions over the last decade, according to Dennis Shirshikov, head of growth at Gosummer.com, a US property management business. “The complexity of sanctions lies in their rapid evolution and the extra-territorial nature of US policies, which can impact non-US institutions. Banks and asset managers, in particular, face heightened exposure due to the sheer volume of cross-border transactions. A key risk for financial institutions is inadvertently facilitating transactions that violate sanctions, which can result in fines reaching billions of dollars, as we have seen with major banks in recent years. For insurers, the challenge is equally significant – insuring assets linked to sanctioned entities can lead to retroactive penalties,” said Shirshikov. “One example is the case of BNP Paribas, which was fined $9bn for violating US sanctions by processing transactions for Sudan, Cuba and Iran. This demonstrates how banks, even when attempting to work within third-party countries, are vulnerable to severe enforcement actions,” Shirshikov continued.

This extended reach of the US sanctions can sometimes cause confusion with locally imposed sanctions and even conflict with local laws, a potential minefield for firms, but the watchword is now one of huge caution, says Michael Feller, a former Australian diplomat now advising global businesses on geo-political risks: “All those banks in Europe and the UK who are providing trade finance to Turkish exporters selling into Kazakhstan are on notice and so they will be having serious talks about de-risking from that exposure.”

Risking reprimand

The International Underwriting Association of London (IUA), an insurance market trade body, provides regular updates to its members to help them identify and avoid such hazards. These updates have changed dramatically over the last decade, highlighting the growing exposures insurers face, says Helen Dalziel, director of public policy: “I have been working at the IUA for 12 years. We do a sanctions spreadsheet for our members, with a monthly update of all the new sanctions. So we keep a close eye on what is going on and during that period we have never known as much activity on sanctions as there is now.”

The biggest challenge, Dalziel says, is getting insurers to look beyond the immediate entities they are insuring, because that is what the regulators are now doing. “You have all these facilitators with the money that are not necessarily sanctioned entities. The enforcement authorities in the US and UK realise they really need to go after the money to try and prevent profit from circumventing sanctions. How does that impact insurance? Because obviously insurance is multi-layered and you have got complex reinsurance arrangements so following the money is not always easy,” explained Dalziel.

This risk is acknowledged by many firms, according to David Langran, a specialist aviation underwriter at Hive Underwriting in London, and is made more complicated by the lack of detail when so many new sanctions are imposed in rapid succession, such as after the Russian invasion of Ukraine: “You know there is a real risk there that we might inadvertently breach sanctions and then find ourselves, as a relatively small insurer, with an existential sort of sum of money that we have got to hand over. Secondly, there is also the political risk that you know sanctions pose a risk to our clients that they may also end up on the wrong side of them,” said Langran.

“With Russia, sanctions were rushed out and they were quite generic. They were not specific and certainly not specific to aviation insurance, so you are left trying to interpret them how they impact us and our clients. And so you end up going back and forth with US, UK Treasury or the EU, asking, what does this mean? And what does that mean? And can you clarify this and clarify that? Particularly when you have got multiple jurisdictions involved and they are not all applying the same sanctions to the same people, the same entities, so you get a mismatch,” Langran told World Finance.

Political risk underwriter Finn McGuirk at Mosaic Syndicate Services in London had a perfect example of this complexity: “We had a claim for a trading client in Switzerland, who, when Belarus was not sanctioned, was doing some metals trades there but when it came to responding to a claim after Putin’s camping exercise turned into something more serious and sanctions were imposed we hit problems. We were paying a Swiss client who had lost money because they had prepaid for steel coming out of Belarus. There should not have been any issue in terms of paying that Swiss client for that loss. But it was just an absolute nightmare to get a clear enough answer out of the UK authorities that was sufficiently helpful to convince the various banks involved in movement of funds and so forth that this was all above board,” McGuirk said.

Financial sanctions: Asset-freezing measures affecting the provision of funds and economic resources to certain entities or individuals (designated persons). They may include restrictions on the use of assets by designated persons, receipt and transfers of funds to particular types of persons and prohibitions on the provision of financing or financial assistance connected to designated persons and prohibited transactions. The current list maintained by the UK Treasury alone contains over 4,800 individuals and corporate entities.

Trade sanctions: These can be more sweeping and prohibit trade in certain goods from affected countries, usually arms and commodities such as oil, timber, gold and diamonds; and equipment for use in the nuclear, oil and gas or petrochemical sector. Many activities related to such trade may be prohibited, such as shipping and construction.

The sanctions slalom

Keeping track of sanctions is a major challenge for every financial institution. Many have expanded their own internal compliance teams, while others rely on external consultancies to keep them up-to-date and raise the red flags when they might be in danger of breaching sanctions. Often the tools used are rather blunt, throwing up the sort of challenges Mosaic had to deal with: “For banks, insurers and asset managers, keeping up with frequent changes to sanctions lists and regulations across multiple jurisdictions can overwhelm compliance teams. A notable issue is the high rate of false positives in sanctions screening which results in wasted time, resources and added operational costs. This is particularly problematic in cross-border payments, where each institution in the chain might repeat the same screening processes, causing delays and inefficiencies,” according to Austin Rulfs, a director of Australian investment and property advisory firm Zanda Wealth.

The reach of sanctions across the financial sector is constantly expanding and is impacting every element of the global financial infrastructure. Clearstream, an international central securities depository based in Luxembourg and part of the Deutsche Börse Group, was fined €9m by the European Central Bank in 2021 for processing payments related to sanctioned Russian entities. The major targets of sanctions such as Iran and Russia have been gradually eased out of SWIFT, the world’s international payments system. This has led to the setting up of parallel payments systems, one of the examples of the perverse way sanctions can work, says Feller, who highlights how some of the BRICS economies have worked together to protect themselves against the impact of sanctions: “Although some of these countries do not have much affinity with Russia they looked at what was happening in the wake of the war in Ukraine and said, I do not want that to happen to me next time I do something bad in my neighbourhood. So let’s buddy up and create an alternative payments architecture. So the answer to being sanctioned off SWIFT is you just invent a new SWIFT and bring the world’s most dynamic emerging markets on board. And the scary thing we are seeing now is that potentially the Saudis are going to be joining this group,” Feller noted.

Crypto crackdown

Cryptocurrencies are also firmly on the regulatory radar screens. “There have been efforts to start targeting cryptocurrency organisations that were allowing the financing of weapons procurement and terrorist financing that were seen as a way of avoiding the US dollar,” says Chmiel.

The US authorities have already targeted one firm, Tornado Cash, which anonymises cryptocurrency transactions which are otherwise recorded. The US alleged these so-called ‘mixers’ were being used to launder stolen cryptocurrency and illicit funds to send to places like North Korea and, hence, imposed sanctions in 2022.

What was innovative about this was that Tornado Cash effectively produced code that was hosted on several cryptocurrency platforms and it was the use of the code itself that was sanctioned. This was the first time that software code had been sanctioned rather than simply putting individuals or entities on the sanctions list. It created the risk that if you were using the code you would be violating sanctions, even if it was not obvious.

These service providers are on a steep learning curve, says Maximillian Hess, principal of Enmetena Advisory and author of Economic War: Ukraine & the Global Conflict Between Russia and the West.

“One of the things that is happening right now in sanctions is we are trying to upskill and institute policies that mean, for example, technology owners and IP owners have to bring in the same kind of compliance departments as banks do,” says Hess.

He points out that other participants in the financial system, such as Euroclear, feel they are caught in the middle as they are forced to freeze Russian and Belarussian assets but fear they could face counter-action by Russia. This issue becomes particularly sensitive when politicians start talking about using frozen Russian assets to rebuild Ukraine.

Hess explains: “Euroclear is really the main story here because it holds $200bn, roughly, of the $300bn frozen. I have some criticisms of how they have retained some of the earlier money although I would not say that they have been directly opposed to releasing it. I think they are taking these Russian counter lawsuits too seriously. I think that the West should do more to make clear that it will defang those counter lawsuits.” If the present looks complex and threatening, the future could be even worse.

Decoding China

The big unknown is China. Nobody knows how Xi Jinping’s pursuit of his dream of this being the Chinese century and his determination to reclaim Taiwan will play out. Nobody really knows how the West will react. The US will undoubtedly lead the way but even it will have to think long and hard about how drastic sanctions action – let alone a military response – will impact its own economy and the economies of its allies.

The cardinal rule of sanctions is that you want to harm the target more than you harm yourself or your allies

“A lot of global institutions, not just financial institutions, and businesses have so much trade, so much business with China it would be so massively dislocating. It is almost too hard to contemplate, isn’t it?” says Smith.

“In many ways it is so hard to contemplate that the US and other countries could take the sort of action we have seen with other countries because any kind of large-scale sanctions on China would boomerang against our own economies and the cardinal rule of sanctions is that you want to harm the target more than you harm yourself or your allies. It is hard to find ways to do that to a jurisdiction like China if the need would ever arise in a way that would not harm US and allied economies as much as China could be hurt,” Smith added.

Does that mean the potential risk of drastic sanctions being imposed on China is only minimal? Ask that question of the experts quoted in this article and you will get many variations of the same answer. Any financial institution that is not assessing its exposure to China and that of its clients would be foolish because the West will not sit back and let China continuously flout the international rule of law: somewhere it will draw a line. When it does it will be equally as disruptive and as rapid as when the West threw a barrage of sanctions at Russia and Belarus in February 2022.