While all recent research shows that the COVID-19 pandemic might be a thing of the past by the summer of 2022, it is not over yet. The last 18 months have proven to be crippling for most people on many different levels. Nevertheless, it has acted as a catalyst for necessary changes as we prepare to exit the COVID-19 era wiser, stronger and better in all aspects.

Many believe we now need to structure our choices around a more sustainable way of living to navigate these difficult times. The reliance on technology has been critical in keeping the world’s interconnectedness afloat while broadening the use of platforms. We believe it will fuel a decade of technological evolution; unlike anything we have experienced in the last 50 years in all sectors. Global financial markets went through unremitting periods but proved very resilient for those who were well prepared. Subsequently, our investors remained confident through these difficult times and are now reaping the benefits of the economic recovery.

The impact on global financial markets

The markets went through some very turbulent times during March 2020, where implied volatilities of stocks and oil spiked to crisis levels. The stock markets dropped as much as 30 percent while oil traded at below $0 per barrel. This was caused by a surplus in supply and a significant drop in demand due to the coronavirus pandemic. Simultaneously, credit spreads on non-investment grade debt dramatically increased as investors braced for a once-in-a-lifetime catastrophe.

However, the governments and central banks were prepared to take all necessary steps and supported the economy significantly. The US alone has brought an extensive fiscal stimulus of more than $5.8trn in three tranches. Two of them under the Trump administration, the $3trn stimulus in spring 2020, the $900bn stimulus in December 2020 and another $1.9trn stimulus this March from President Biden. Of course, we are also expecting the $2trn infrastructure bill to follow soon. The combined total exceeds $7.8trn in contributions to households and businesses. Comparatively, the sum is a far more extensive response to the COVID-19 crisis when compared to the 2008 global financial crisis.

Arguably, the above stimulus has sparked fears that hyperinflation will stay for years to come. The counterargument proposes that most of the financial support went directly to households to protect them from rising debts and helped them to increase their savings. These savings will prove vital if the Federal Reserve and central banks decide to delay their monetary tightening. Central banks not fulfilling their mandates to maintain inflation below two percent is a base case scenario for our investment committee. Otherwise, increasing yields could take indebted companies to bankruptcy, and a recession will follow. Consequently, the trillions spent to deter a decade-long recession will be immaterial.

Investors are keen to get back to normal

We see some risks associated with rising consumerism in sectors like real estate. Consumers refrained from making purchases during the pandemic. This helped build up a backlog of demand that became apparent after Q2 2021 when the first signs of recovery emerged. As a result of rising inflation, investors are keen on placing their bets once again in the real estate market, but things are a bit different this time. The real estate market has rapidly corrected since the drop from its all-time highs. We firmly believe it can promptly bring new highs with the recorded demand from domestic and international investors, especially in developed capitals.

We believe that global stock and bond markets will move to the next phase of mature growth, which will be reflected in investment flows

These developments are not isolated to the real estate market. Despite fears of a slowdown, the global economy shows signs of stability, with the stock markets preparing for another positive year. Nasdaq predominantly led the rally as tech stocks were resilient during the pandemic and made the case for digital evolution in a short period. While we believe tech stocks will continue their incredible performance for years to come, our focus has turned to value sectors and banking since the beginning of this year.

As we revert to everyday life and habits, specific sectors will begin to outperform during the following years. For instance, health companies will be of great importance in any portfolio. This is because people getting out of this pandemic now understand how R&D can prevent this from reoccurring. Additionally, mRNA technology will rise as a new approach to medicine.

Infrastructure companies are another area we are focusing on. Emerging from the pandemic our habits changed quite a lot and we believe that the ‘working from home’ concept will become mainstream for many companies, so fewer people will be required to commute to and from their physical offices. Additionally, the huge spike in digital retail sales during the pandemic will force retailers to re-think their physical presence with local branches. We expect infrastructure companies to play a significant role in transforming our cities. The $2bn infrastructure investments will – apart from demand – help to increase the supply side, which is vital to the economy and public finances. Another sector we have already invested in is banking. With all the turbulence in 2020, banks have shown that they are well capitalised and prepared to play a significant role in helping reshape our economies. That is why we believe banks are going through one of their best periods in history. All big banks announced better than expected profits. They were much higher than the estimates in several cases, causing a sharp rise in their stock price. Many banks have increased or are expected to increase the dividend they distribute to stimulate investment interest. However, the most important clue comes from the repurchases of own equity. Since the end of 2020, this practice has been allowed and utilised by banks. Subsequently, repurchases of own shares are intensifying month by month. Between August 9 and August 13 alone, banks bought $1.26bn worth of treasury shares. No other sector carries out more intense share buyback programmes. According to a report by BofA, a study of similar data from 2020 shows that banks have a strong chance of outperforming all other sectors in the coming months.

Our post-pandemic expectations

We believe that global stock and bond markets will move to the next phase of mature growth, which will be reflected in investment flows. Thus, we will experience a decade of growth in stock markets.

At XSpot Wealth, we analyse all possible scenarios and prepare our different plans with complex stress testing tools to respond to sharp market movements. All our plans are expected to produce great results by the end of 2021, a year that many believed would be negative for the stock markets. We have strategically shifted away from treasuries in riskier plans. As the economic trajectory continued to improve, we added an ESG-only thematic plan to our offerings. Not only do we believe flows in ESG investments will keep increasing but that returns of such investments will prove far more attractive.

With the markets entering the mature growth phase, capital movements to the banking, tourism, hotel, energy, and value sectors are already visible. There may even be an attempt for more sustainable growth in China. As time goes on, the situation in China is quite likely to start its normalisation course. As always, global markets will show signs of normalisation earlier, and that is why we are closely following the developments regarding a possible change in trend. Trading volumes in Chinese ETFs continue to be large. This is a very positive indicator as a potential trend change will have a solid basis. There is a particular focus in the Chinese technological sector, which is now trying to break the uptrend of the last six months following its recent drop.

Digital disruption is the way forward

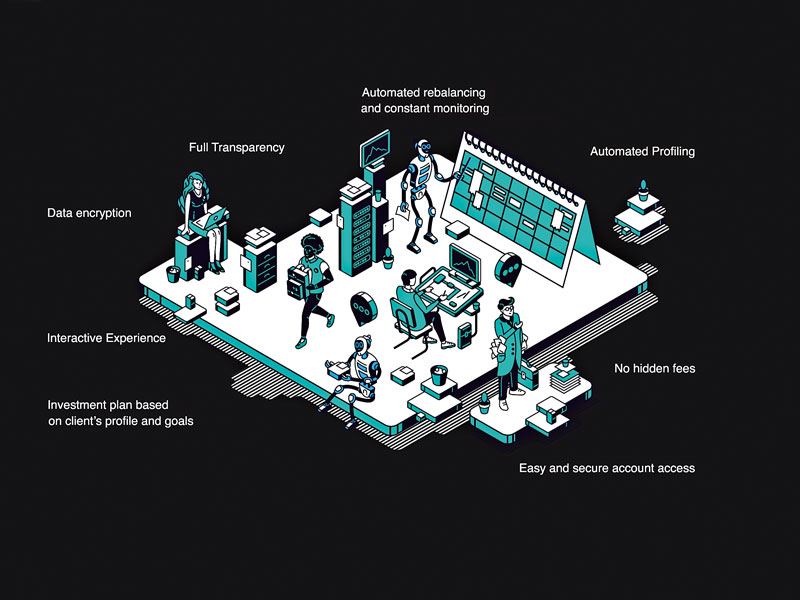

At XSpot Wealth, our teams are working to augment artificial intelligence in most business actions. Our Robo-advisor program is designed to address clients’ needs better, faster and in a more efficient way. These developments are essential as private investors are moving away from the traditional models. We are expanding quickly and our clientele is growing at a rate that is 30 percent faster than last year as we prepare to expand in the Middle East with our office in Dubai.

Furthermore, we have started offering our technology to regional banks, asset managers and family offices, to expand our reach and strengthen institutions. This is achieved through a robust solution that can easily connect to existing infrastructures. This can contribute to the development of their offering through the automation of operations and the provision of advanced and personalised services to their customers. We are helping to provide a cost-effective solution with reduced risk and access to the world’s top-rated custodians and prime brokers.